BREAKING: Sable Special Committee Will Investigate Findings by Hunterbrook; $SOC Will Try to Raise $225M to Extend Exxon Loan

Sable did not reiterate its claim that an audio recording published by Hunterbrook was “AI generated.”

By: Sam Koppelman

Editor: Wendy Nardi

Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $SOC at the time of publication. Positions may change at any time. See website for full disclosures.

This morning, on an urgent public investor call, Exxon Mobil spinout Sable Offshore announced it had formed a Special Committee to investigate reporting by Hunterbrook Media revealing that $SOC may have shared material nonpublic information (MNPI, or insider info) with a select group of investors.

On the investor call, Sable also appeared to confirm Hunterbrook’s reporting that it would need to raise equity funding — around $225 million, Sable disclosed, in order to extend the maturity date of its key loan from Exxon, the prior owner of the oil and gas project. The announced raise would dilute existing shareholders by about 20% based on the roughly $8.30 price per share at the time of this publication.

READ: Exxon Spinout Sable Leaked Key Info To Investors Including Golfer Phil Mickelson

The upcoming equity raise had previously not been widely disclosed — though it had been mentioned to a small group of investors on a private call, the leaked recording of which Hunterbrook published on Friday. Sable disclosed this morning that the $225 million equity raise is a requirement to extend the duration of its loan with Exxon. Without this extension, Exxon could reclaim the project without any payment to Sable. The project is Sable’s sole asset.

Sable initially claimed that October call was “either AI generated or otherwise altered” in a comment to Hunterbrook.

In this morning’s statement, Sable did not claim AI and appeared to acknowledge the call was real, saying it was looking into the “audio recording of a call that took place in October 2025.”

Sable added: “We have no further comment while the investigation is ongoing.”

Sable also confirmed that it is now primarily pursuing an offshore shipment approach to produce oil and gas, called FPSO (floating production storage and offloading), rather than the company’s original goal of relaunching a pipeline that runs through Santa Barbara.

The project had been shut down under prior ownership after causing one of the worst oil spills in California history.

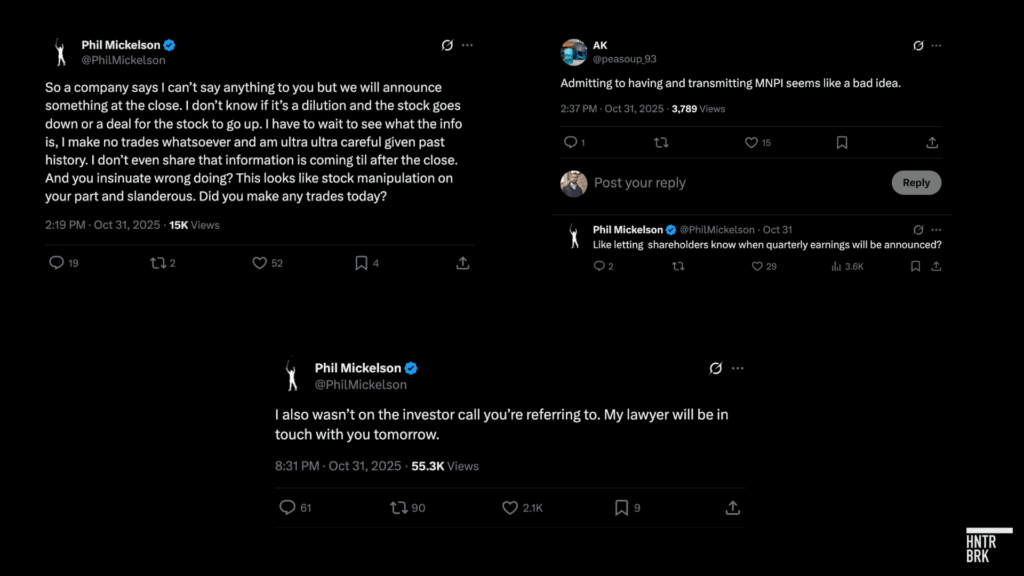

Star golfer and $SOC investor Phil Mickelson, who declined to comment to Hunterbrook in advance of publication of the Friday article, provided his take on the story on X. He said he was “ultra ultra careful” when trading Sable stock, and claimed that he did not know if the company announcements he had learned about in advance would be positive or negative.

Hunterbrook reported that Mickelson had passed on a tip allegedly from Sable’s CEO Jim Flores in an X group chat on September 29 that the company would be issuing an 8-K filing about a material update later that day. Sable did in fact issue a market-moving 8-K that afternoon.

“I don’t know if it’s a dilution and the stock goes down or a deal for the stock to go up,” Mickelson wrote in response to Hunterbrook’s reporting in a comment on X Friday. “I have to wait to see what the info is.”

In another post, Mickelson compared knowing about a material 8-K filing in advance to knowing about quarterly earnings. (Notably, investors are told quarterly earnings dates in advance, whereas the timing of 8-Ks is not publicly announced.)

Mickelson also tweeted to clarify he was not on “the investor call” from Hunterbrook’s reporting. Hunterbrook did not report that Mickelson was on the call; rather, that he had been a participant in a separate private group chat of Sable investors.

“My lawyer will be in touch with you tomorrow,” he wrote in his final missive, at 8:31 pm ET on October 31.

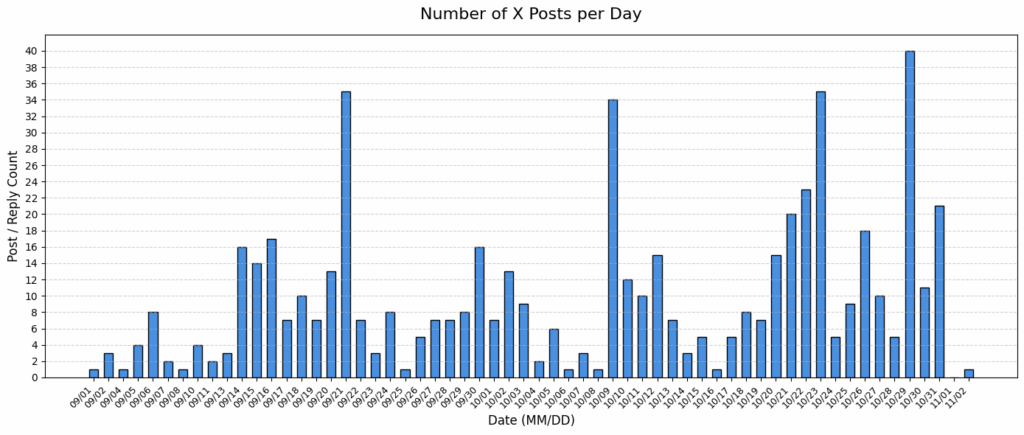

Mickelson — who had averaged about 10 posts on X a day over the past month — did not post again until 9 p.m. ET on Sunday, November 2, the longest he has gone without posting on X since August.

Author

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Editor

Wendy Nardi joined Hunterbrook after working as a developmental and copy editor for academic publishers, government agencies, Fortune 500 companies, and international scholars. She has been a researcher and writer for documentary series and a regular contributor to The Boston Globe. Her other publications range from magazine features to fiction in literary journals. She has an MA in Philosophy from Columbia University and a BA in English from the University of Virginia.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided “as is” without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.