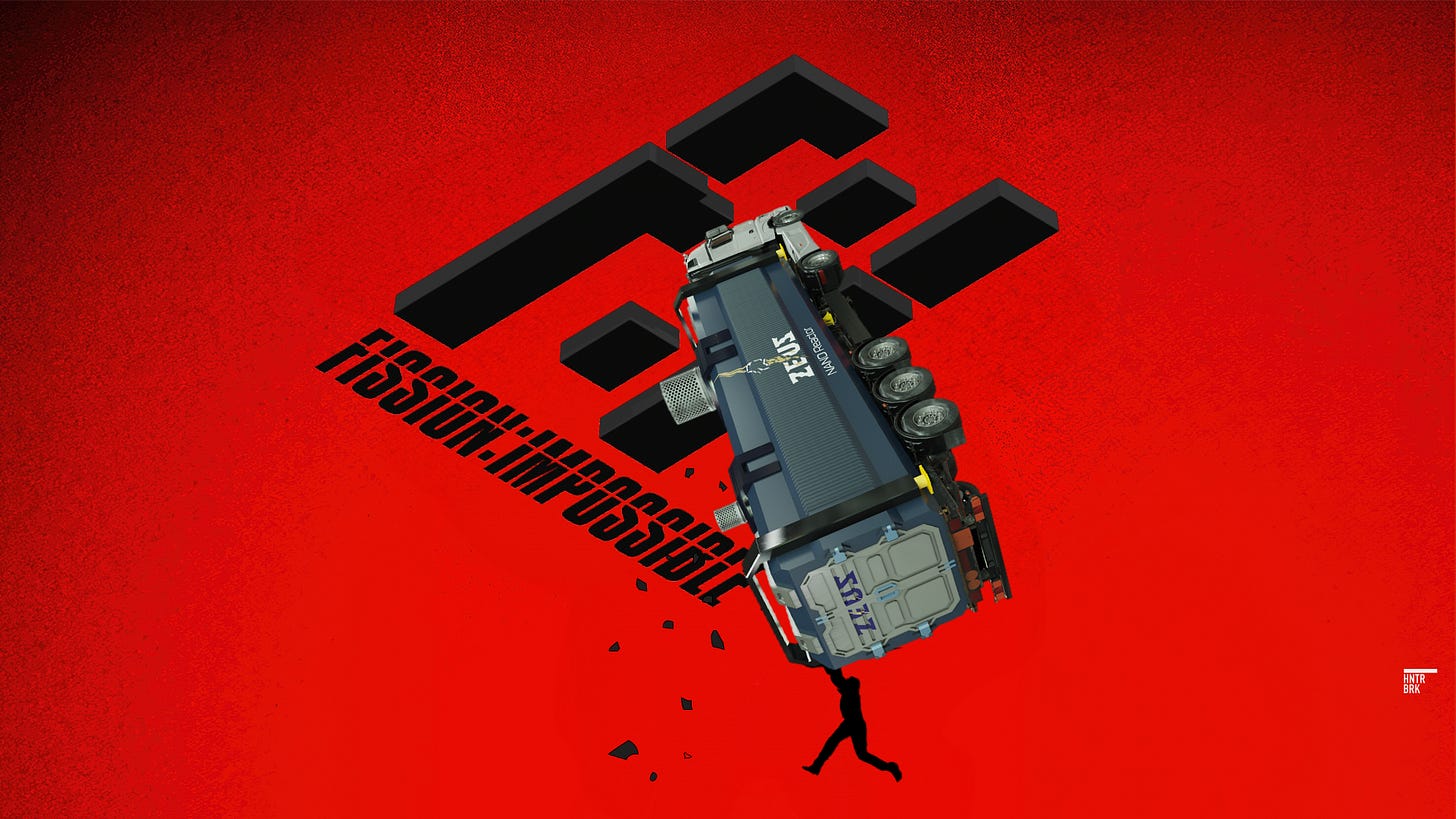

Fission Impossible: Nano Nuclear ($NNE) has no revenue, no products, "laughable" timelines, part-time executives, and a $600 million market cap.

NNE spent just $290,000 on research and development in the first quarter.

By: Jake Conley

Editor: Jim Impoco, Daniel Sherwood

Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $NNE.

Nano Nuclear Energy (NASDAQ: $NNE) stock rose over 450% after going public in May, reaching a market cap of more than $850 million, even though the company has no revenue, products, or patents for its core technology.

NNE estimates that it will bring nuclear microreactors to market between 2030 and 2031. An expert called this timeline “frankly laughable.” The former chair of the Nuclear Regulatory Commission told Hunterbrook it “won’t happen” — given that competitors with more resources have taken 15-20 years for similar projects.

Building a single small modular reactor, the product closest to what NNE is pitching that has actually been developed, costs at least hundreds of millions of dollars for research and development. NNE reported having just under $6 million in cash in the first quarter of 2024. During the same quarter, NNE spent much more on advertising ($434,800) than it did on research and development ($290,000), despite its status as a pre-product, pre-revenue company.

NNE’s executive chairman and president, CEO, and CFO work as independent contractors at the company and continue to hold senior management positions at other public companies. The stock price of each of those companies sits below $1.00 — and several have market caps under $5 million.

The company’s auditor was recently sanctioned and fined by the Public Company Accounting Oversight Board for taking on hundreds of SPAC clients without necessary resources.

As of July 2024, the U.S. Nuclear Regulatory Commission does not list NNE among the companies that have begun pre-application activities for the kind of reactor NNE is pitching. An NRC spokesperson told Hunterbrook Media that the Advanced Reactor department is “not aware of this company” and “we have not had any pre-application dealings with them.”

Despite reportedly saying approvals were “pretty much complete” for a uranium fuel fabrication facility, NNE only claims to have submitted an initial site proposal with the Department of Energy in August 2023, and the company appears to have filed no permitting or regulatory application documents with the NRC, according to a review of the agency’s online public records portal.

NNE did not respond to repeated requests for comment.

As a stock music take on the Pirates of the Caribbean soundtrack blares, an animated container ship sails into port carrying a small nuclear reactor emblazoned with the word “ZEUS.”

On shore, an inconspicuous warehouse is revealed to house a reactor of its own. This one is called “ODIN,” and it’s powering, in some undefined way, a facility producing fabricated uranium.

A truck drives out of the warehouse hauling drums of nuclear fuel across picturesque backcountry roads.

These futuristic images are from a marketing video made by Nano Nuclear Energy Inc., a publicly listed startup that has seen its stock price spike by more than 450% since listing on the Nasdaq earlier this year.

NNE’s pitch, as seen in the video, is that it is creating a first-of-its-kind vertically integrated portable nuclear microreactor company. The plan calls for acquiring enriched uranium, turning it into usable fuel, transporting it on its own trucks to its own cutting-edge reactors, and running a consulting business that sells companies and governments on the benefits of nuclear technology.

It’s a wildly ambitious vision, which, if at all plausible, would require billions of dollars in research and development to complete.

But a review by Hunterbrook Media of NNE’s regulatory filings, government records, and past projects involving the company’s executives — as well as conversations with experts from the industry and an NRC spokesperson — suggests that the company’s big dreams are at best completely out of touch with reality.

In the first quarter of 2024 — shortly before it went public — NNE spent only $290,539 developing its technology.

That’s less than NNE spent on advertising — despite Hunterbrook’s research indicating the company has yet to produce a prototype, patent its technology, or begin the formal process of government approval.

NNE has nonetheless promised to bring its reactors online on a significantly more aggressive timeline than those of competitors with orders of magnitude more cash on hand — who are much further along in their research and development.

And NNE will attempt to do so with a leadership team that does not work at NNE full-time — and whose backgrounds include a long line of stints at public companies that are now penny stocks, according to Hunterbrook’s research.

Paul Dorfman, a visiting fellow at the University of Sussex’s Science Policy Research Unit — and one of four nuclear experts, including the former Chair of the Nuclear Regulatory Commission, who spoke with Hunterbrook for this investigation — said he believes Nano Nuclear is a “money-making exercise” for its executives. “And they know it is.”

“They cannot produce this stuff in the time scales that they promise,” he said. “It is an impossibility.”

GOING NUCLEAR

With the world in search of sustainable sources of energy, nuclear power is suddenly hot — and generating legislative wins in the United States after decades of stagnation.

On July 9, the president signed a law designed to accelerate nuclear technology development and make permitting a faster and easier process. This built on the Inflation Reduction Act, passed into law in 2022, which allocated funding to domestic development of high-assay low-enriched uranium, the kind of fuel needed to power NNE’s technology.

And a year earlier, the U.S. government launched The Foundational Infrastructure for Responsible Use of Small Modular Reactor Technology program, designed to support global initiatives to develop small modular reactors.

The theory behind SMRs is that they could be factory-assembled, then shipped to wherever they are needed. This portability could enable SMRs to deliver power to remote communities unconnected to the grid, such as remote population centers in Canada’s far north, or mining sites far from other power sources.

Proponents also argue scaled-down reactors could be not just more cost-effective and easier to build than the full-scale plants producing the world’s nuclear energy today but also safer and far less damaging environmentally. Bill Gates, who founded and chairs the board of TerraPower, LLC, a company developing its own SMR, wrote in a blog post about the technology that “the world needs to make a big bet on nuclear.”

NNE says it plans to go even further, building microreactors small enough to be driven around the country in one piece on a semi-trailer truck for use in space exploration, data centers and AI programs, military bases, and other applications.

But despite the increase in NNE’s share price since going public, the company appears to have accomplished little more than producing animated videos and slide decks. And its plans for when and how its reactors will enter commercial service are implausible, according to the nuclear experts who spoke with Hunterbrook.

“LUDICROUS,” “LAUGHABLE” TIMELINES THAT “WON’T HAPPEN”

Licensing a nuclear technology development and getting it approved by the government is a complicated, expensive, and often glacial endeavor. The Nuclear Regulatory Commission, the government office responsible for overseeing the industry, requires reviews on multiple fronts, public hearings, proposals, and reports.

NuScale Power Corp. (NASDAQ: $SMR), the only company in the U.S. to get an SMR design approved by the NRC, began the pre-application process for its design 16 years ago, in 2008; didn’t receive approval from the NRC until 2023; and wasn’t expected to bring its technology to market until 2029 or 2030.

After NuScale spent more than $1.8 billion — with an expected total development cost of more than $9 billion — the company was unable to find enough buyers to justify commercial production of its reactor and shut the project down. The company’s stock fell 37% the day of the announcement.

Traditional nuclear power companies are also exploring SMR technology. Westinghouse Electric Co. LLC, a major U.S. electric company with years of experience in the nuclear sector, has been developing a microreactor since at least 2019, with an expected launch date of 2027 or later.

Despite its pre-product and pre-revenue status, Nano Nuclear predicts in regulatory filings that its Zeus and Odin reactors will be brought to market between 2030 and 2031, shaving a decade or more off the process compared to competitors, seemingly without a clear plan for how to go about doing so.

Allison Macfarlane, the director of the University British Columbia’s School of Public Policy and Global Affairs and a prior chair of the NRC, told Hunterbrook that “won’t happen.”

“Commercialize the reactors by 2030? That’s five years from now,” Macfarlane said. She noted that licensing alone could easily take six or seven years.

The NRC publishes an online “summary of non-LWR reactor designers and non-power research and test reactors that have formally notified the NRC of their intent to engage in regulatory interactions.” (The NRC classifies microreactors like NNE’s as non-LWR reactors.) As of July 17, 2024, Nano Nuclear Energy was not one of them.

Nor is NNE listed on the NRC’s webpage detailing the SMR companies it is currently working with. A report from February 2024 from the director of the NRC’s Office of Nuclear Reactor Regulation to the NRC’s commissioners, which detailed progress made on both non-LWR programs and SMR programs, noted that the NRC has engaged in “preapplication interactions” with several non-LWR and SMR developers, but does not mention NNE in either list.

In fact, NNE does not appear to have filed any documents with the NRC at all, suggesting the company has yet to begin the formal process, according to Hunterbrook’s review of the NRC’s Web-Based Adams Database of records.

An NRC public affairs officer told Hunterbrook on a phone call: “I reached out to our Advanced Reactor folks and they are not aware of this company.” He later clarified, “Or at least is not aware of any pre-application discussions with them. That should be my more cautious and more confident statement, not that we haven’t heard of them but that we have not had any pre-application dealings with them.”

Hunterbrook found one mention of NNE in a landscape analysis in an NRC portal.

NNE, which claims it will develop its reactors and fuel fabrication facility in collaboration with the Idaho National Laboratory, a major U.S. government-affiliated nuclear research lab, announced in February that the INL had completed a “pre-conceptual review” of the company’s Odin reactor design and later said in an SEC filing that the INL had audited the designs for both reactors.

The INL was not quoted in the press release — and did not respond when Hunterbrook reached out for comment on whether it has a relationship with NNE.

In NNE’s Form S-1 filed on July 9, the company said its reactors had moved from “the design stages to physical test work stages, with initial rig construction currently underway.”

So at this rate, how long might it take for NNE to start generating electricity?

“It’s possible that, you know, somebody like Elon Musk or Sam Altman could simply write them a check for, you know, $10 billion and say, ‘OK, go ahead and make this,’” said M.V. Ramana, a professor and physicist at the University of British Columbia who studies small modular reactors. “If somebody does that, then I would say 15 to 20 years.” (Sam Altman is the chairman of Oklo (NYSE: $OKLO), which is also developing a microreactor.)

Nano says it will be online in six years.

The company also says it expects to earn approval for, and build a fuel fabrication facility within, the next three years, a timeline Dorfman told Hunterbrook was “frankly laughable.”

“You look straightaway at the development progress charts, and you see it’s just not doable,” Dorfman said. “There’s no question — it just cannot happen.” NNE predicting that it will have reactors launched by 2030, he said, is “kind of ludicrous.”

Nano did not respond to requests for comment.

NANO’S PROPOSED VERTICALLY INTEGRATED, SOUP-TO-NUCLEAR SUPPLY CHAIN

NNE is trying something especially ambitious: setting up full vertical supply-chain integration, via several subsidiary companies.

AMERICAN URANIUM

It all begins with American Uranium, Inc., which the company says will be responsible for the “acquisition, exploration & development” of uranium properties on U.S. soil. But as of July 2024, according to a prospectus filed by NNE with the SEC, American Uranium’s operations have not commenced.

In an interview with psychologist and provocateur Jordan Peterson that was filmed on January 30, 2024, and later posted to YouTube, NNE CEO Walker said the company plans to source uranium from Central Asia and said the company has “talked with the largest uranium materials broker in the world.” Walker didn’t clarify in the interview whether the company has placed any orders to reserve supply.

HALEU ENERGY FUEL

The next link in the vertically integrated supply chain is fabrication, through HALEU Energy Fuel Inc., a subsidiary that NNE says will convert HALEU into a usable form to power its own reactors and sell commercially. (HALEU stands for high-assay, low-enriched uranium, the kind of uranium that is required for many advanced reactors.) NNE says HALEU Energy Fuel Inc. will fabricate uranium enriched up to 20%, which is above the minimum level needed for use in nuclear weapons.

In August 2023, NNE announced that it had filed a proposal to build a HALEU facility at the Idaho National Laboratory. The company said in regulatory filings it planned to purchase land in the second quarter of 2024 for the development of a HALEU fabrication plant that would be the first of its kind in the U.S.

As reported by an industry trade publication in May 2023, Walker said that the required approvals for the plant were “pretty much complete” and estimated that construction on the project could possibly start this year. NNE stated in a filing that “initial site preparation is scheduled to begin in 2025, with completion of construction and commissioning occurring in 2027.”

Nano is also a member of the Department of Energy’s HALEU Consortium, an initiative started by the Department to provide estimates of domestic commercial demand for HALEU and eventually purchase the fuel.

But the company has not issued a press release announcing the purchase of land for the development of such a facility. Once it does, building a fabrication plant would require regulatory signoff by the NRC, according to Macfarlane, the former chair of the NRC — and its records database does not include a permit application from NNE.

Centrus Energy Corp. (NYSE: $LEU) is the only company in the U.S. licensed to enrich uranium up to the levels commonly needed for SMR and microreactor designs. Centrus began doing so at its Piketon, Ohio, plant in 2023, as the first American-owned uranium enrichment plant to begin operations in 70 years. In March 2023, NNE signed a memorandum of understanding with Centrus that says the companies will “explore” the possibility of Centrus providing HALEU to NNE’s HALEU Energy Inc. while NNE gets its own uranium supply going.

But the memorandum is nonexclusive and nonbinding. And it could take Centrus several years to start producing HALEU at commercial levels, Matthew Memmott, an associate professor of chemical engineering at Brigham Young University, told Hunterbrook. Centrus itself said it could potentially scale its production up within 42 months — if the company secures enough funding.

Macfarlane, the former NRC chair, noted that Nano will not be the only company eager to buy Centrus’ HALEU fuel.

ADVANCED FUEL TRANSPORT

After the fuel is fabricated, NNE says another subsidiary, Advanced Fuel Transport Inc., will “produce a governmentally licensed and permitted high-capacity HALEU transportation product, capable of moving commercial quantities of HALEU fuel around North America,” according to company statements in regulatory filings.

NNE has signed a patent licensing agreement with Battelle Energy Alliance LLC, which runs one of the U.S. government’s primary nuclear research facilities, for a design of a transportation system for HALEU. But Advanced Fuel Transport Inc. has not commenced operations as of July 2024, NNE said in a regulatory filing.

SHORT-TERM MONETIZATION?

If licensing for its reactors is likely far off, and its subsidiaries have not begun operating, how does Nano Nuclear Energy plan to make money in the short term?

When Nano announced that it had bought the intellectual property rights to a design of cooling technology for use in its proposed reactors, the company said it believed there was “significant potential for this technology to be separately commercialized within a year,” possibly via utilization by nuclear companies such as TerraPower and Oklo.

Within a day of the announcement, Nano’s stock jumped upward by more than 35%.

Ramana, however, said this plan is unlikely to work, as a company that wanted to use the new technology for a reactor would likely have to pursue fresh licensing from the NRC to use the new device.

NNE also said it plans to buy a nuclear consulting firm and “start providing nuclear service support and consultation services for the nuclear energy industry, both domestically and internationally” by the end of 2024, according to its regulatory filing.

To hedge against the possibility that the company might not buy a consultancy by the end of the year, NNE said in a regulatory filing that it is focusing on building its own from the ground up at an estimated cost of $1 million to $2 million. (Nano separately quotes both figures in the filing).

INTELLECTUAL PROPERTY AND PATENTS

Nano seems to own barely any IP, including for its reactor designs — the crux of its business model. NNE appears to have only filed for a provisional patent for its Zeus reactor, and it licenses the patent for a HALEU fuel transport container design from Battelle Energy Alliance. (Provisional patents establish an early effective filing date but aren’t examined by the U.S. Patent and Trademark Office.)

Compare this to NuScale, which says it owns more than 500 granted or pending patents across 21 countries.

NNE says in regulatory filings that it has “opted to maintain such technology as a trade secret” and that it expects to file utility or design patents for its Zeus and Odin reactors in March 2025.

Memmott, who has designed and built components of microreactors, told Hunterbrook that this isn’t necessarily odd. He explained that it’s very likely that NNE is still adjusting their designs and wouldn’t want to file for patents prematurely.

GIG ECONOMIES OF SCALE

NNE is helmed by a suite of leaders who, at first glance, seem legitimate enough. Jay Jiang Yu, the company’s executive chairman, president, secretary, and treasurer, sits at the head of multiple public and private companies and a nonprofit organization. Walker, the CEO, is a nuclear physicist who has worked for Rolls-Royce and the UK’s Ministry of Defence. The CFO, Jaisun Garcha, has been the financial head of numerous companies in similar sectors.

But a review by Hunterbrook of these executives’ backgrounds raises questions about their ability to spearhead a complex nuclear venture.

NNE’s senior executives aren’t actually full-time employees of the company. Instead, the leaders are independent contractors, which NNE explained in a filing is because they all hold leadership positions at other companies.

While flaunting its “world class” team with “extensive experience in successfully securing funding,” NNE does not mention that the stock price of all of the companies where it says its executives work sit below $1.00. Many of the companies at which NNE’s executives are splitting their time are worth less than $20 million.

One company at which Walker is a director, a Canadian metals exploration company called Xander Resources, is worth approximately $750,000. Stock in Ares Strategic Mining, a lithium exploration company at which Walker is the CEO, trades at $0.14 and has a market cap of under $30 million. Garcha is or has been the CFO of at least three public companies other than NNE, two of which are in the natural resources sector. All three now trade under $1.00, with market caps under $16 million.

A profile of Jay Jiang Yu in lifestyle publication Haute Living referred to him as “a man with a Midas touch” for entrepreneurship and compared Yu to Jimi Hendrix, Lionel Messi, and Pablo Picasso. Another profile, published by Nigerian newspaper Vanguard, called Yu a “classic rags-to-riches story” claiming he has “business interests in everything from gold-mining, fintech, private aviation, blockchain, and various medical industries.” NNE referred to Yu in a filing as a “serial entrepreneur” who has “key, strategic and valuable relationships” and is “geared at taking these companies to the next level.”

But at a Canadian mining exploration venture called St. James Gold Corp., where Yu and Garcha hold identical positions to theirs at NNE, the market cap has fallen to under $5 million.

Overseeing these executives at Nano is WithumSmith+Brown, the company’s auditor, which in February was sanctioned and fined $2 million by the Public Company Accounting Oversight Board, the nonprofit set up under the Sarbanes-Oxley Act to oversee auditors of public companies.

Nano also recently closed an equity deal with the underwriter The Benchmark Company, which has a history of working with underperforming companies. Hunterbrook’s review of stock price movements at companies that The Benchmark Company worked with showed a median decline in stock price of more than 40% in the following year.

The Benchmark Company did not respond to a request for comment.

And while NNE has brought on scientists with strong track records to lead the development of their reactors, they, too, have other jobs.

Massimiliano Fratoni and Peter Hosemann, the duo developing the Zeus reactor, are both engineering professors at UC Berkeley. The development of the Odin reactor is being led by scientists Ian Farnan, who is part of the research leadership at the Cambridge Nuclear Energy Centre and a past visiting professor at Stanford, and Eugene Shwageraus, a nuclear engineering professor at Cambridge University who previously taught in the nuclear engineering department at MIT.

The company counts among its executive advisors bigwigs such as Andrew Cuomo, the former New York governor who resigned amid an explosive sexual harassment scandal. He has denied the allegations.

Also on the advisory board is onetime presidential hopeful and former NATO commander Wesley Clark.

Clark was previously on the board of two companies that went bankrupt, in 2015 and 2018, and another that was charged with accounting fraud by the SEC in 2011 for falsely reporting sales and recognizing revenue improperly. Clark was not personally accused of wrongdoing.

Earlier in the month, Fox Business Network brought on Jon Najarian, an options trader, longtime CNBC stock market commentator, and past NFL linebacker, to talk about nuclear companies and how the sector has recently been exploding in value.

Najarian brought up NNE: “I know two insiders in this company and they are very happy campers because this thing has just zoomed since it’s come public.”

On July 15, Nano Nuclear announced that it had sold 900,000 new shares — and warrants to purchase 517,500 shares at $20, below its current price — diluting the total public share count.

The company said in a press release that it grossed $20.7 million on the offering. Nano has also begun selling merch. A box of six golf balls emblazoned with the Nano Nuclear logo goes for $26.99.

Author

Jake Conley is an investigative reporter who has covered everything from fracking and sea slavery to ghost guns and Kevin Spacey. He has an M.S. from the Columbia Journalism School, where he was a Toni Stabile fellow for investigative journalism. Jake is based in New Jersey.

Michelle Cera contributed reporting.

Editors

Jim Impoco, Editor-at-Large at Hunterbrook, is the award-winning former editor-in-chief of Newsweek who returned the publication to print in 2014. Before that, he was executive editor at Thomson Reuters Digital, Sunday Business Editor at The New York Times, and Assistant Managing Editor at Fortune. Jim, who started his journalism career as a Tokyo-based reporter for The Associated Press and U.S. News & World Report, has a Master’s in Chinese and Japanese History from the University of California at Berkeley.

Daniel Sherwood joined Hunterbrook as a Senior Investigator and Financial Editor from The Capitol Forum, a premium subscription financial publication, where he was an Editor & Senior Correspondent, writing and managing market-moving investigative reports and building the Upstream database. Prior to The Capitol Forum, Daniel has experience conducting undercover investigations into fossil fuel companies and other research. He also served as an Honors Law Clerk in the Criminal Enforcement Division of the EPA. He has a JD from Michigan State University. Daniel is based in Michigan.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.