Holiday Weekend Feature: Will Penn's big wager on ESPN Bet pay off?

We went to the depths of Reddit — and Hoboken — to find out.

By: Eve Peyser

Editor: Sam Koppelman

Hunterbrook Media’s investment affiliate, Hunterbrook Capital, did not take any positions related to this article.

It was a dreary Sunday in January, but at the Wicked Wolf Tavern in Hoboken, the mood was electric.

It was way, way, way too loud, and the walls were lined with an astronomical number of televisions, all beaming in the AFC Championship Game. The place was full of women with tight blue jeans and little handbags, and men wearing Ravens jerseys, Chiefs jerseys, backwards hats, and forwards hats.

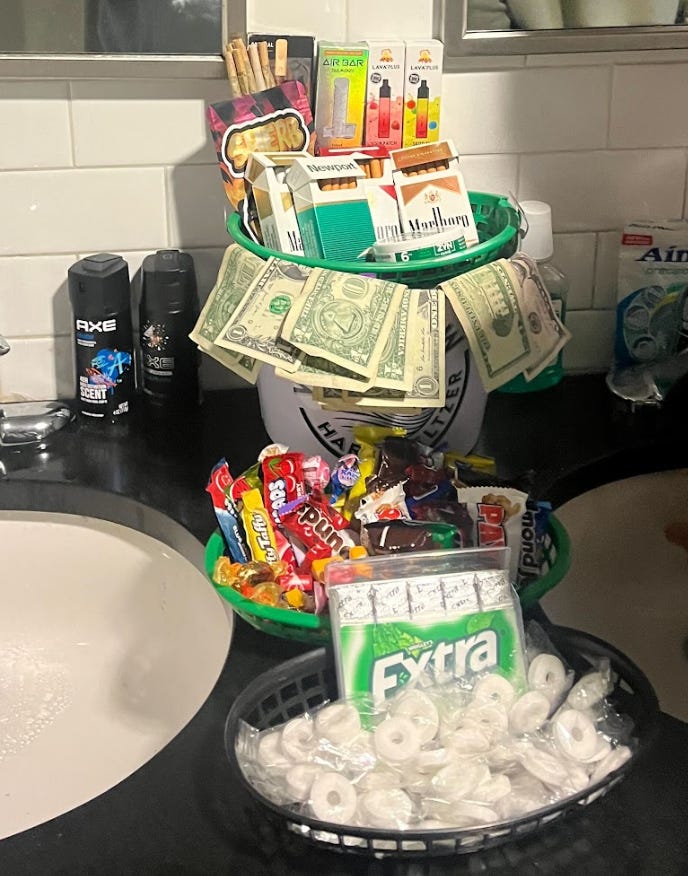

The sports bar, which looks out onto the Hudson River and is located on Frank Sinatra Drive, had very strong New Jersey energy, including, inevitably, patrons representing Rutgers. People were freely vaping. The floor was covered in confetti. In the men’s bathroom, an attendant hocked menthol cigarettes, pre-rolled joints, and Skittles-flavored e-cigarettes. In the women’s bathroom, no such luck. (Sexist much?)

Despite the festive atmosphere, I wasn’t there to party. I was there to watch football and, hopefully, get rich.

Today, there are many places in the United States where one can bet on sports. Since the Supreme Court revoked a 1992 federal law that prohibited state-sanctioned sports wagering in 2018, the industry has blossomed. Laws vary from state to state, but two states stand out among the crowd for having the greatest number of online sportsbooks: Colorado and New Jersey. (It’s a vibe.)

This was why I had journeyed to the Garden State—after all, one does not simply go to Hoboken for no reason. Across the Hudson, in New York, I could’ve bet on the Chiefs to best the Ravens on FanDuel, DraftKings, BetMGM, and Caesars Sportsbook, among others. But I was here to investigate ESPN Bet, which was not yet licensed to operate in the Big Apple.

Less than a month later, Penn Entertainment Inc. (NASDAQ: $PENN), the company that owns ESPN Bet, purchased New York sports gambling licenses as part of a $25 million deal. (The company plans to launch ESPN Bet in the country’s biggest sports betting market this fall.)

But in January, it was Hoboken or bust for me.

As the game started, I set up accounts on ESPN Bet and DraftKings, taking advantage of the free money the apps offer for first-time users. Both apps were easy to use, but DraftKings offered new players $200 in free bets, while ESPN Bet only offered $150. DraftKings also lets users place bets on what would happen on the next possession of the game (e.g., the Chiefs will punt); ESPN Bet did not have that feature at the time.

I sipped on a nonalcoholic beer and, somewhat haphazardly, began to make wagers on ESPN Bet and DraftKings.

Then a woman accompanied by a man with several nose piercings approached my booth. They asked if I was interested in $25 in free food or drinks. The catch was simple: All I had to do was sign up for Caesars Sportsbook and place my first bet.

This kind of marketing, they told me, was illegal in New York, but allowed in New Jersey. They had similar offers for several other apps, but none for ESPN Bet. I paced around the bar and saw another patron making his own wagers on FanDuel. Between the time I stepped onto the PATH train and finished watching the AFC Championship Game, my world had been subsumed by sports gambling.

Before all this, I didn’t care about the outcome of the game because I’m a hardcore Seattle Seahawks fan and evidently less interested in Taylor Swift than the average American. Once I was in New Jersey and had money on the line, I became very invested in who would win (I bet on the Kansas City Chiefs) and whether Baltimore Ravens quarterback Lamar Jackson would score the fourth touchdown of the game (which would have turned my $25 free bonus bet into $125).

But I was so locked into my phone, manically going back and forth between ESPN Bet and DraftKings, that I was missing the action. I felt a strange urge to put money on everything and anything. I wished I could bet on how many Patrick Mahomes State Farm commercials would air.

The idea of winning was appealing, sure, but even more fun was getting creative with my bets. I made some really stupid parlays and I didn’t care because I was using free money. I was excited by the proposition that I could turn a $20 bonus bet into $642.25 if Odell Beckham Jr., Zay Flowers, and Isiah Pacheco each scored a touchdown. (God damn you OBJ for not getting me there!)

As my parlays began to fall apart, DJ Khaled’s voice boomed through the speakers: “All I do is win, win, win, no matter what.” Couldn’t be me.

In my reverie, I almost lost track of the whole reason I went to Hoboken to begin with.

Months before my voyage to the Garden State, I had learned everything I could about Penn Entertainment (NASDAQ: $PENN) and ESPN Bet. I had combed through countless tweets and Reddit posts and app store reviews. I had scanned hundreds of pages of SEC filings and vacuumed up every morsel of news and tried to make sense of each state’s abstruse revenue data.

I wanted to find out who Penn Entertainment was as a business and whether investors should actually buy into the hype about ESPN Bet. I’m no stock wizard, but I’m skeptical, curious, and a pretty good internet sleuth. The research I had done suggested Penn Entertainment had management issues, and bettors preferred FanDuel and DraftKings to ESPN Bet.

Still, to truly understand ESPN Bet, I needed to try it out myself.

I lived in Nevada for two years, and it was there that I began to appreciate why a person could get addicted to gambling, and the pleasure that comes with both the wins and losses, the alluring rhythm of the slot machine, and the fantastic notion that a little bit of luck could change your life.

I’ve always liked gambling but was never compulsive about it. And I am a fundamentally compulsive person. I gave up alcohol in 2016, after spending my teen years and early 20s wallowing in a drunken stupor. Still, I was never particularly concerned about becoming a gambling addict; the thing I liked about drinking and drugs was how they altered my brain chemistry. Getting deep into something that would mainly result in losing money did not have the same draw.

Nevertheless, I wanted to be careful — in part, because I have family members who are gambling addicts, but mostly, because even though I’ve been sober for years, when I find something new that I like, I go extraordinarily hard. I am most pathological when it comes to gaming. I spend at least an hour a day playing word games. I have played many hundreds of hours of video games like Animal Crossing and Balatro and Into the Breach, and many, many thousands of hours of Grand Theft Auto.

Would sports betting be like playing slots, something I enjoy doing for a maximum of 15 minutes? Or would it scratch the same itch as playing video games? Would one afternoon of wagering on football get me hooked for good?

And if so, would it even matter if I placed my bets on FanDuel or DraftKings or ESPN Bet?

Those were the questions I was asking myself as I inhaled that sweet secondhand Hoboken vape smoke and took in the kind of hopium you can only find in a bar full of sports bettors and diehard fans.

Oh, and there was one other question I was asking, the one I was on assignment to answer: Did ESPN Bet stand a chance?

In the online sports betting industry, there are two titans, FanDuel and DraftKings. Then there’s everybody else. Penn Entertainment, a company that operates seemingly mid casinos across the United States, got into the game in 2021 with Barstool Sportsbook.

The company had purchased 36% of Barstool Sports, the sports media empire, the prior year — and acquired a 100% stake in 2023, for which it paid a total of about $523 hundred million in cash and $28 million in stock.

But the app failed to capture a significant portion of the market.

And just months after Penn’s decision to complete its purchase of Barstool, it abruptly sold the company back to its founder, Dave Portnoy, for $1. Why? Well, according to CEO Jay Snowden, Penn had been presented with “the opportunity of the century.”

In August 2023, Penn signed a 10-year, $2 billion licensing deal with ESPN, and several months later, relaunched its sports betting app as ESPN Bet.

The response to the deal in the press was largely optimistic: “ESPN Bet seems to be off to a fantastic start after its Tuesday launch,” USA Today declared in a November article. “In the two days since, the ESPN Bet app has set a record for the most downloads of any sports betting app in a two-day span. … If the estimates prove true, it puts PENN Entertainment and ESPN Bet on a great path for success.”

“App downloads have been exceptional,” Barry Jonas, managing director at Truist Securities Inc., told CDC Gaming Reports in November, noting that 1.6% of adults who live in states where ESPN Bet operates have downloaded the app. “The power of the ESPN brand speaks to success so far.”

Bloomberg reported that upon the announcement, DraftKings saw its shares fall by over 6%.

Despite the generally positive coverage, the more I researched ESPN Bet, the more dubious I was that Penn’s deal with ESPN was working out as well as everyone seemed to think it was — and the company’s financials ultimately backed me up.

In February, Penn Entertainment reported that its online sports betting arm had lost $333.8 million in its first quarter in operation. In May, that segment of the business reported $196 million in losses. Penn had earned less with ESPN Bet in the first quarter of 2024 than it had back in the first quarter of 2023, when the app was called Barstool Sports.

The company gave all kinds of rationalizations, including that its losses were a result of customer acquisition costs that would pay off in the long run — but the market didn’t seem to buy them. Penn’s stock dropped by as much as 19% in February, and then another 15% in May. And I wasn’t buying it, either.

Because, sure, ESPN Bet had millions of users. But Penn was paying to acquire those customers (e.g., bet at least $5 on the app, get $250 in free bets). And the thing is, after you pay to acquire users, you have to keep them. You only get free drinks at a casino because they expect you to stay and gamble.

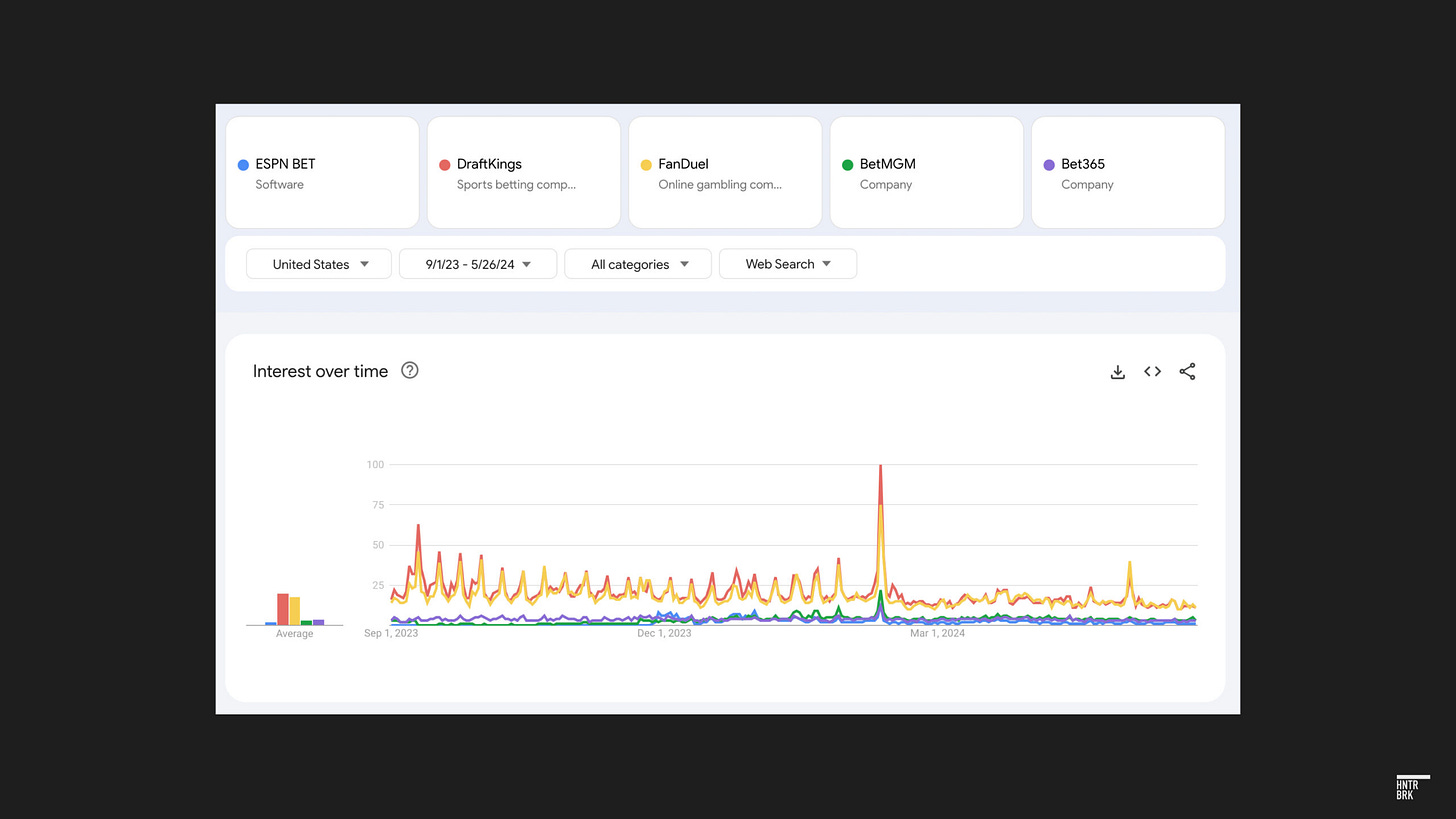

Penn has claimed in its investor presentation that it had succeeded with customer retention, but our research has shown that interest in the app overall may be down. While Google searches for ESPN Bet spiked when it was first launched, they have since sharply declined.

In the Google Play store, ESPN Bet’s download velocity has decreased significantly.

Graph via AppBrain

Based on publicly available information from state gaming commissions analyzed by Hunterbrook Media, ESPN Bet has captured about 6.2% of the sports betting market in the United States. That is a significant increase from when it was Barstool Sports, but it is still a long way from legitimately competing with DraftKings and FanDuel. If you only count states where ESPN Bet operates, we estimate it holds 7.7% of the market. As of May 2024, ESPN Bet is allowed to operate in 18 states, trailing behind DraftKings, FanDuel, BetMGM, Caesars, and Fanatics.

Also, some customers seem to like it less than its competitors, so once they do use their free bets on ESPN Bet, why wouldn’t they just go back to DraftKings and FanDuel?

ESPN Bet’s ratings on Google Play, after all, are worse than those of its main competitors. And the feedback online hasn’t been particularly kind either.

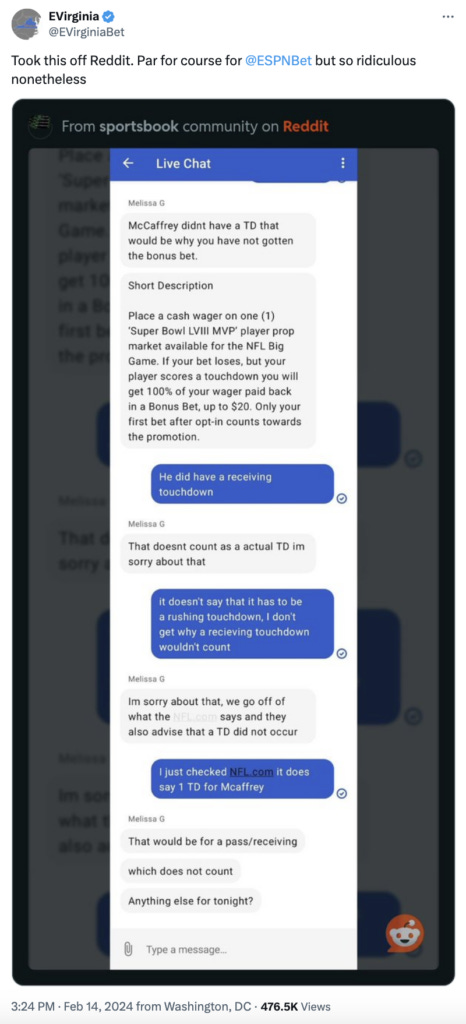

After the Super Bowl, a redditor shared a screenshot of an alleged conversation with ESPN Bet customer service. They claimed to have bet that Christian McCaffrey, the running back for the San Francisco 49ers, would score a touchdown, and ESPN Bet customer service allegedly told them that it would not honor their bet because his receiving touchdown “doesn’t count as an actual TD.” (The user’s bet apparently did not specify the type of touchdown McCaffrey would make.) Other ESPN Bet users have made similar complaints. Then again, after losing, bettors are inclined to say that they were cheated.

Users have also complained about not being able to withdraw their funds in a timely manner. Greg Hagan, a web developer who lives in Philadelphia, told me that he has had an “absolutely abysmal” experience on ESPN Bet. “Trying to make a bet while the game is live is nigh on impossible,” he said. “I use FanDuel. Like FanDuel is my primary app. And I am able to make bets in live games. Like, yeah, the odds may go down. But I have the option to accept odds changes.”

Steven, who says he is a professional bettor who has earned over $50,000 on sports wagers since October, also prefers FanDuel over its competitors and said that many people feel the same way. “FanDuel treats people fairly,” he told me in an interview. “And a lot of these places, they don’t treat people fairly.”

Steven told me that he no longer uses ESPN Bet because, in February, after he’d had a particularly strong month, it limited the amount he could wager because he was making too much money. (He requested that I omit his last name, so as not to draw attention to his gambling successes, because people who make a lot of money sports gambling often face limits on the amount they can wager.)

Blake Krass, who writes about sports betting for The Action Network, told me in an interview that he believes ESPN Bet’s “main problem is really just customer service.” Krass has heard myriad complaints about the app, ranging from players being offered less favorable odds to long wait-times for user verification to fewer opportunities for players to cash out early. He said that people had similar complaints when the app was marketed under the Barstool name.

Regarding ESPN Bet, he told me that in his state, “as somebody who works in this space and is having so many conversations with people, I don’t know anybody personally that uses it.”

Neither ESPN nor Penn Entertainment responded to Hunterbrook Media’s questions.

ESPN Bet is Penn’s second attempt at attaching a popular brand name to its sportsbook. Will ESPN, which has wider name recognition and appeals to a broader audience than Barstool, change Penn’s fortunes?

Attaching a beloved brand to your new product can help a company reach more consumers. When I covered the Annual Licensing Expo for the New York Times in 2022, Jason Lim, who works at a slot machine company called Ainsworth Game Technology, told me, “Machine X can generate, let’s say, $10,000 a day. Put a piece of I.P. on it, it’s generating $100,000 a day.”

Penn has a lot riding on its deal with ESPN — $2 billion over 10 years is a serious amount of cash for a company whose market cap has fallen from a high of $21 billion to under $3 billion today.

So how did we even get here? Why the Hail Mary?

The company was born in the early 1970s, after Pennsylvania legalized betting on thoroughbred horse races. In 1982, the company renamed itself Penn National Gaming. Twelve years later, it went public on the Nasdaq, raising millions to pay off debt and build off-track betting parlors. In 1999, the company started buying casinos around the country, expanding throughout the decade.

In 2012, the company split, moving a large share of its real estate holdings to Gaming and Leisure Properties Inc., a company that describes itself as “the nation’s first gaming real estate investment trust.” Since the split, GLPI has built a market cap about $10 billion greater than Penn’s.

But like many casino businesses, Penn struggled when COVID-19 hit in 2020. It furloughed 26,000 workers in the state of Nevada and sold the Tropicana, which it had bought in 2015 for $360 million, to GLPI.

That’s the context in which Penn acquired a stake in Barstool, the hugely popular sports media company founded by Dave Portnoy, known for being reliably vulgar and very bro-y. Just four years before Penn invested in Barstool at a valuation of over $450 million, the Chernin Group, a private equity firm, had bought 51% of the company for between $10 million and $15 million.

Eight months after its own investment, Penn launched Barstool Sportsbook, its first foray into online sports gambling, despite some warning signs. In a New York Times investigation into Portnoy and Barstool Sportsbook — which Portnoy called a “hatchet job” riddled with “factual inaccuracies” — Emily Steel wrote:

Mr. Portnoy, 45, rose to fame by capitalizing on misogyny and other offensive behavior. He once said that some women “kind of deserve to be raped.” He wouldn’t remove photos showing a toddler’s penis from his blog until police showed up at his door. He made what he acknowledged were racist statements, including using the N-word repeatedly. He outed women who accused him of sexual misconduct, threatened to fire employees engaged in unionizing and repeatedly incited attacks on his critics.

Penn CEO Jay Snowden reportedly called Portnoy and other Barstool staffers “geniuses” after first meeting them in 2019.

Gambling being a highly regulated industry, Portnoy’s behavior did not sit too well with state gaming boards — which, according to Portnoy (who once called himself a “degenerate gambler”) had denied Penn gaming licenses because of him.

So perhaps it shouldn’t have come as such a surprise that, just months after purchasing the majority of Barstool for $388 million, when the ESPN Bet opportunity came along, Penn sold the company back to Portnoy for a dollar.

It also doesn’t seem like Penn was left much of a choice by ESPN Bet: The contract between the two parties mandated a total divestment from Barstool. Which made sense, because according to The Wall Street Journal, the whole reason ESPN was so late getting into the sports gambling market to begin with is because it was at odds with Disney’s image as a family-friendly company. And, well, Barstool is about as family friendly as Patrick Bateman’s browsing history.

Penn and Disney closed their deal last August — and it has several interesting clauses, including the right for ESPN to back out for a wide variety of reasons, one of which would be Penn failing to achieve an adequate share of the market in the next three years. The contract doesn’t specify a number, but Snowden has said it is around 10%.

In an industry dominated by DraftKings and FanDuel — with gaming apps from big brands like MGM, Caesars, and Fanatics also on the market — many analysts believe it will be tricky for ESPN Bet to claim, and maintain, a sizable share nationally. Then again, a few decades ago, it was difficult to imagine a world in which Nokia wasn’t the biggest player in mobile phones. Could FanDuel and DraftKings meet a similar fate? Does ESPN Bet have a real shot at supplanting them?

Ed Miller, a professional poker player who has worked as an oddsmaker for sportsbooks and written several books on sports betting, told me that it may come down to ESPN Bet’s ability to stand out from its competitors.

“Think about the old time-y slot machines, where it’s like a cherry, a lemon, and an orange on some reels,” said Ed Miller. “It’s like, OK. That’s fun for a minute. Whereas the modern slots, there’s a whole soundscape that comes with them. They ding and boom and do all these things. You click the button and it’s like, are you gonna get the bonus? All that stuff is designed by smart people who know what’s … appealing to people.”

If ESPN Bet wants to build a loyal audience, he said, it should make the app fun and novel. “Nailing that in-game betting experience is really where an upstart could genuinely compete, because I definitely think there’s room for someone to come in with something that’s just literally more fun than existing products.”

FanDuel, for example, has started offering bettors the option of watching the games they bet on in the app. Manny Fidel, who regularly wagers on sports and lives in New York, told me that he placed a bet on FanDuel just so he could watch a game that was streaming on a service he didn’t subscribe to.

Though it feels intuitive for ESPN’s sports betting app to offer a similar feature, I wouldn’t count on it. Earlier this year, Disney announced that it planned to partner with Fox and Warner Bros. Discovery to launch a new sports streaming service. In Penn’s Q4 earnings call, Snowden suggested that Disney wasn’t planning to integrate ESPN Bet directly into that service.

Meanwhile, the NBA recently began incorporating sports betting into its League Pass service. Subscribers now have the option to watch games overlaid with point spreads, over-unders, and moneylines displayed on the screen. If you want to place a bet, the app will direct you to DraftKings or FanDuel. If you want to place a bet on another platform, like ESPN Bet, you’re out of luck.

For ESPN Bet to challenge FanDuel and DraftKings’ dominance over the sports betting market, it’s up to Penn to make a better app than its two biggest competitors. And the company might not have the funds to make that happen. Sportsbooks operate on slim margins and profitability is difficult, even for the biggest names in the game.

Not only did Penn lose hundreds of millions of dollars in the fourth quarter of 2023 in part because it launched ESPN Bet, but the revenue for the entire organization, including its casino properties, declined $190 million between 2022 and 2023. And Penn has already promised to cut — not increase — marketing expenses for ESPN Bet by 20%.

In an encouraging move, in April, Penn hired a new Chief Technology Officer: Aaron LaBerge, who spent two decades at Disney, and most recently was ESPN’s CTO.

DraftKings, meanwhile, appears to be committed to expanding its business. In February, the company announced it would acquire Jackpocket, one of the most popular lottery apps in the U.S. It has also cut the amount of money it spends on marketing, but only by 2.6% — continuing to spend over $300 million a quarter on marketing.

Hunterbrook Media estimates that, factoring in the money Penn is paying Disney as well as off-channel marketing, ESPN Bet is spending about $162.30 on marketing per average monthly user. By this metric, DraftKings and FanDuel are spending significantly more: $271.50 and $316.80, respectively.

Part of what makes Penn’s partnership with ESPN feel so promising is that the app receives significant promotion on the ESPN network. But that doesn’t guarantee that ESPN personalities will necessarily hype the product.

After Penn released its 2024 first-quarter earnings, Pat McAfee, the football punter turned mega-popular sports commentator, joked about ESPN Bet’s failure to launch, on his eponymous show. (ESPN is reportedly paying McAfee $85 million over five years to license his show on the network.)

During McAfee’s May 2 show, he pointed to the ESPN Bet graphic above his head and said sarcastically, “Things are going great here.”

“NOT!” interjected a second speaker.

“Not at all,” McAfee said, laughing, and then launched into a silly pep talk, “Let’s go ESPN Bet! Hey, you get knocked down, you come back.” McAfee also mused, “I don’t think ESPN people are running the book. I think it’s somebody with a whole thing. With that said, let’s go. You’ve got ESPN on it. Come on … let’s go!”

The following day, McAfee again brought up ESPN Bet’s struggles on his program. “The tech has to be good. That is the number one thing. I don’t know if a lot of these sportsbooks, or newer sportsbooks, understand that. The user experience has to be … great. If not, there’s other options.”

Nonetheless, Snowden has painted a rosy picture of the future for ESPN Bet. The problem is he said, well, basically the same things about Barstool Sportsbook.

Snowden, February 2023: “Barstool is a proven, powerful media brand.”

Snowden, November 2023: “ESPN’s unmatched brand and reach is a powerful combination.”

Snowden, February 2023: “Barstool Sportsbook will greatly benefit from the upcoming migration to our proprietary technology stack.”

Snowden, November 2023: “ESPN BET will be powered by our proprietary and proven technology platform.”

Ah yes. This brings to mind George W. Bush’s most iconic flub: “Fool me once, shame on, shame on you. Fool me—you can’t get fooled again.”

The sun had set, the Chiefs had defeated the Ravens, and I had won a few dozen dollars, which meant I could leave Hoboken. Approaching the train station, which was plastered with FanDuel ads, I wondered if this experience had changed me, if I was going to be a sports bettor from now on.

When I got back to my sister’s apartment in Manhattan to watch the NFC Championship game, I was off the clock, but I couldn’t help myself: I had to place a few more bets. Was I on my way to becoming a “degenerate gambler” like Dave Portnoy? Or was I just being a drama queen?

As it turns out, the latter. Back home in Washington State, the only legal sports gambling happens at casinos, not on smartphones. I could drive 10 minutes to Oregon to use DraftKings, but I haven’t felt inclined to do so. Still, the fleeting compulsiveness I felt when it came to betting on sports in Hoboken made me understand the fun of the whole thing, and why Americans wagered over $100 billion on sports in 2023.

Logging onto DraftKings or ESPN Bet is not the same as playing a scratcher or using a slot machine. Even though the average sports bettor is largely beholden to chance, the whole thing also requires some strategy, which makes you feel like you’re in control of your own destiny. I liked that. I liked that I was given the opportunity to play a mini-game while watching people play an actual game. And because I follow sports news pretty closely, it gave me the illusion that I could use my knowledge to get rich.

Since I’ve been back home, I’ve been spammed by marketing emails from DraftKings, begging me to come back to the app. And strangely, I haven’t heard a peep from ESPN Bet.

I don’t think ESPN Bet is going to be a total failure because it hasn’t spammed me with a million messages. I’m actually confident it will be significantly more successful than Barstool Sportsbook. (And as Greenlight Capital wrote in an investor letter earlier this year, Penn’s casino business alone may very well be worth more than the company’s entire current market cap.) But ESPN Bet is a pipsqueak in a landscape dominated by two giants.

For ESPN Bet to effectively compete with DraftKings or FanDuel — or break free from competitors like Fanatics and Bet MGM — experts told me Penn would need to invest in app design and marketing, be willing to think outside the box, and understand that an app needs more than licensing to succeed.

With the company already losing hundreds of millions of dollars on its big ESPN Bet gamble — and having burned hundreds of millions more on Barstool — it’s unclear if Penn has the chip stack to make the big bets it needs to win the pot. But, for now at least, they’re still at the table.

Eve Peyser writes about the weirdest, funniest, and most interesting aspects of modern life. Her work has been featured in The New York Times, Vanity Fair, GQ, and many other publications.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.