$PZZA Gate: Papa Johns Stock Soars On Apparent Fake Buyout News

Papa Johns International ($PZZA) stock surged more than 13% today on what appears to be a scheme using fake news distribution websites to spread false reports of a takeover.

By: Sam Koppelman, Blake Spendley

Editor: Till Daldrup

Based on Hunterbrook Media’s reporting, Hunterbrook Capital is short $PZZA at the time of publication. Positions may change at any time. See website for full disclosures.

Papa Johns International ($PZZA) stock surged more than 13% today on what appears to be a scheme using fake news distribution websites to spread false reports of a $65-per-share acquisition offer from private equity firm TriArtisan Capital Advisors.

The move follows last week’s report that Apollo had withdrawn an unrelated $64 offer for Papa Johns, priming traders to react to M&A talk in the name after PZZA’s recent earnings. The stock fell over 20% after Reuters broke the news that Apollo was not moving forward.

A “person familiar with the matter” allegedly told Seeking Alpha today’s “report is not true.”

Here is our best understanding of how this rumor spread:

The Fake News Network

The earliest version identified by Hunterbrook appeared on BusinessMole, crediting a post on NewsReleases.co.uk, a WordPress‑based feed that openly solicits businesses to “get featured” by emailing advertise@newsreleases.co.uk.

BusinessMole’s page lists “Newsteam PR” as the poster and shows a “Last updated” time of 1:26 pm (UK), roughly an hour before the U.S. stock market opened.

The article was then picked up more widely after it was syndicated by a website called ABC Money, which investors may have mistaken for ABC News. In fact, ABC Money is a UK-based company that is in receivership, and appears to be a spoof of ABC.

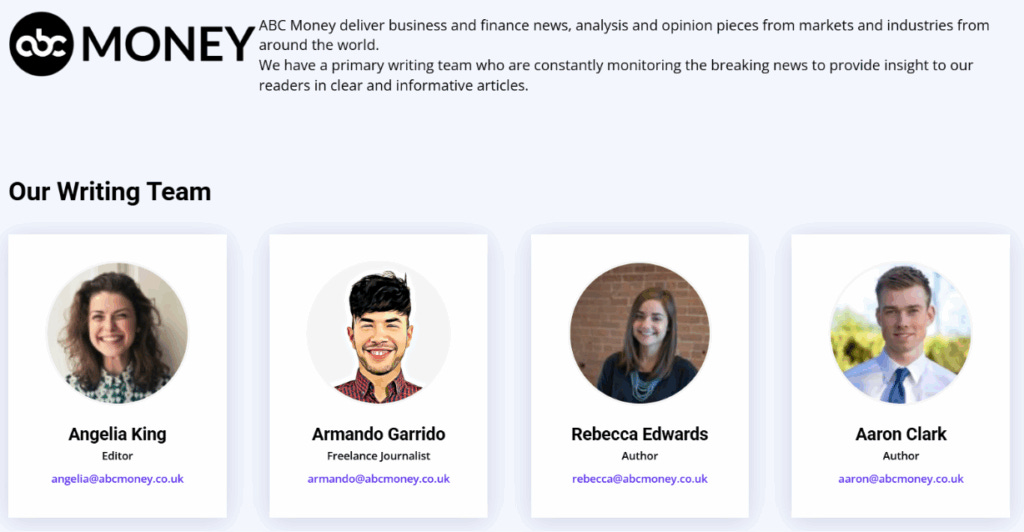

On its “about us” page, ABC Money purports to have a writing team, with multiple staff journalists.

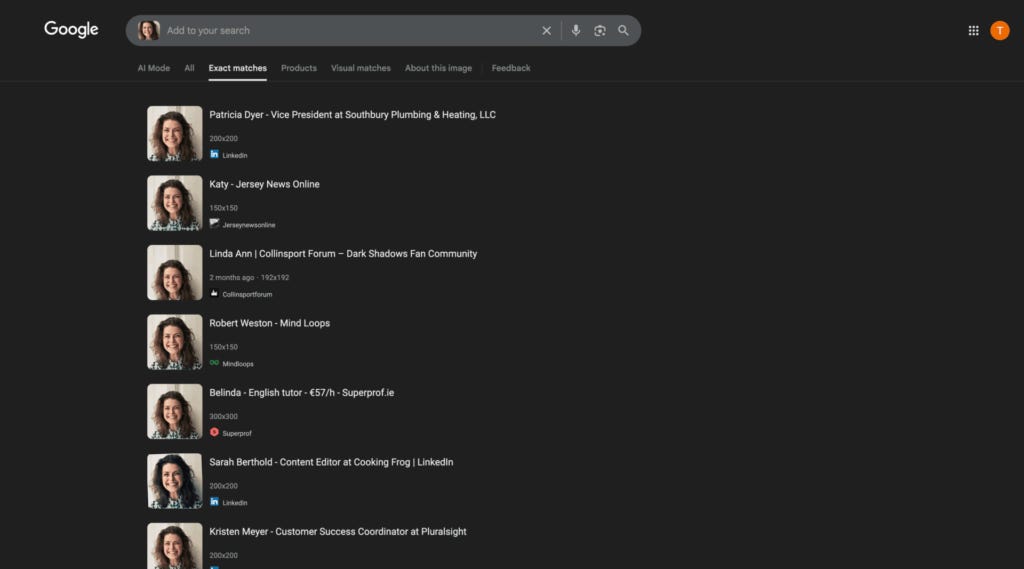

When Hunterbrook ran those profile photos through reverse image search, most appear to have been stolen from other sources, and did not match the names listed on ABC Money’s site.

ABC Money — which did not respond to Hunterbrook Media’s request for comment — also appears to be using a logo that looks eerily similar to that of the actual ABC.

The ABC Money article was cited by both Seeking Alpha and Barron’s in their coverage of the rumor.

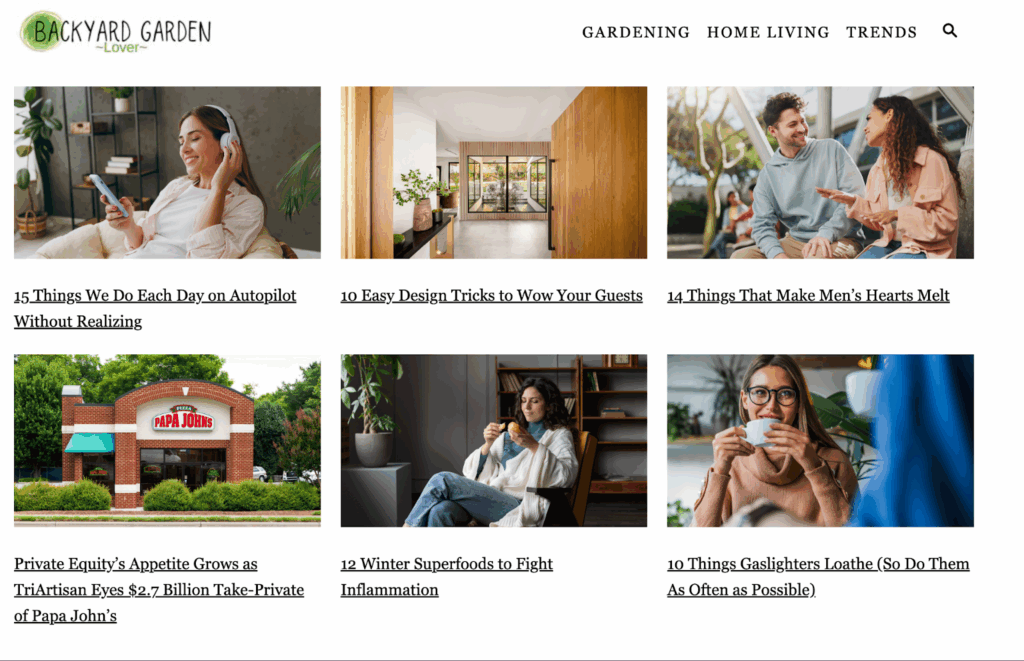

Another widely-syndicated article about this acquisition came from a website called Backyard Garden Lover. The headline: “Private Equity’s Appetite Grows as TriArtisan Eyes $2.7 Billion Take-Private of Papa John’s.”

That article was cached on Google over 120 websites, despite the fact that Backyard Garden Lover appears to be, well, a gardening blog.

Its alleged author, Chantelle Kincy, calls herself a “Women’s Wellness and Luxury Travel Writer” in what appears to be her Instagram bio.

Kincy could not be reached for comment; but on her Instagram, she seemed to be on a flight over China in her most recent story, raising the possibility that Backyard Garden Lover — which could not immediately be reached for comment — is using Kincy’s name without her knowledge.

Papa Johns’ investor relations site carried no announcement Monday, and no SEC filing has been posted to corroborate a transaction. TriArtisan did not issue a statement.

A principal at TriArtisan picked up the phone but did not respond to request for comment. Barron’s, which cited ABC Money’s report in its own article, reported both Papa Johns and TriArtisan declined comment.

Authors

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Blake Spendley joined Hunterbrook from the Center for Naval Analyses (CNA), where he led investigations as a Research Specialist for the Marine Corps and US Navy. He built and owns the leading open-source intelligence (OSINT) account on X/Twitter, called @OSINTTechnical (over 1 million followers), which also distributes Hunterbrook Media reporting. His OSINT research has been published in Bloomberg, the Wall Street Journal, and The Economist, among other top business outlets. He has a BA in Political Science from USC.

Editor

Till Daldrup joined Hunterbrook from The Wall Street Journal, where he focused on open-source investigations and content verification. In 2023, he was part of a team of reporters who won a Gerald Loeb Award for an investigation that revealed how Russia is stealing grain from occupied parts of Ukraine. He has an M.A. in Journalism from New York University and a B.S. in Social Sciences from University of Cologne. He’s also an alum of the Cologne School of Journalism (Kölner Journalistenschule). Till is based in New York.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided “as is” without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.