UWM’S SHELL GAME: HOW UNITED WHOLESALE MORTGAGE EXECUTIVES HELPED CREATE AN “INDEPENDENT” COMPANY THAT HAS SENT UWM AN ESTIMATED $1.9 BILLION IN LOANS

UMortgage “manipulates” rate sheets in UWM’s favor, according to a former employee.

Author: Matt Termine

Editor: Sam Koppelman

Hunterbrook Capital is short $UWMC and long $RKT. This is not investment advice. Positions may change after publication. See hntrbrk.com for full disclaimer.

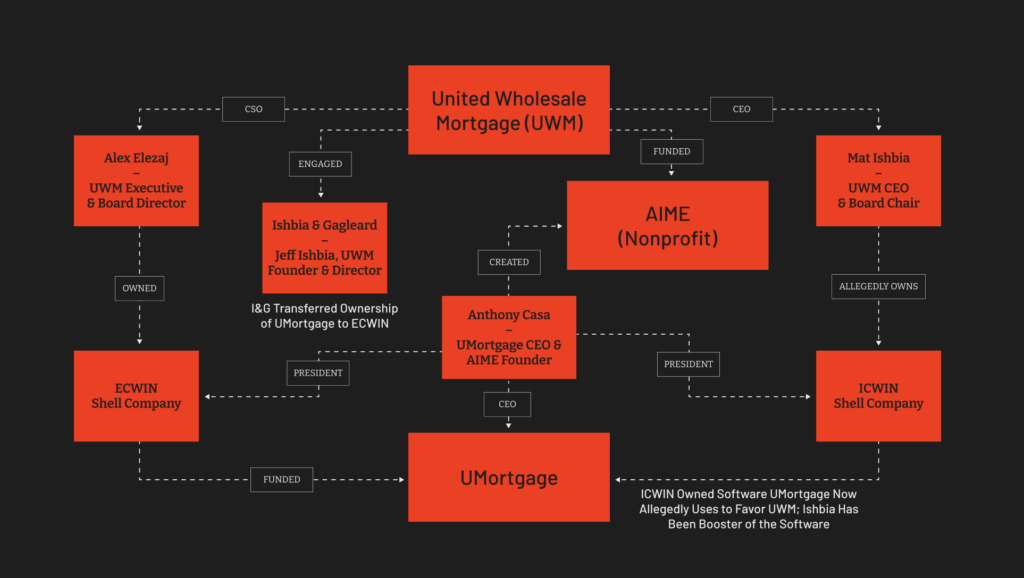

TLDR: UWM is the largest mortgage lender in the United States. UMortgage is a purportedly independent mortgage company. FOIA documents and other public records reveal: 1) UWM executive and board member Alex Elezaj funded UMortgage via a shell company. 2) UMortgage sets prices to make UWM look cheaper than competitors, claims a former employee who filed an internal complaint related to the company’s finances and was then terminated. 3) UMortgage has sent UWM an estimated $1.9 billion in loans from 2021 to 2023, about 77% of UMortgage’s business. 4) UWM CEO Mat Ishbia has maintained a close relationship with UMortgage CEO Anthony Casa, whose past includes personal bankruptcy, an arrest related to an alleged domestic dispute, and resigning from UWM-funded nonprofit AIME after making vulgar comments about a Rocket Mortgage executive’s wife. 5) UWM founder and board member Jeff Ishbia’s law firm helped transfer ownership in UMortgage to the company funded by Elezaj and Casa. 6) UMortgage’s loyalty to UWM is part of a broader pattern of so-called independent brokers sending UWM the vast majority of their home borrowers, in potential violation of state and federal laws. This pattern has led a group of home borrowers and a major law firm to file a national RICO conspiracy class action lawsuit against UWM. “The whole thing was collusion,” said a former Executive Director of the National Association of Mortgage Brokers.

On April 2, Hunterbrook Media revealed that United Wholesale Mortgage (NYSE: $UWMC) had become the largest lender in the country with the help of a lie: Thousands of purportedly independent mortgage brokers — which UWM said shopped among dozens of lenders to find the best deal for homebuyers — almost always sent their business to UWM, according to a data analysis spanning millions of state and federal records. The company had pressured them in its contracts and deployed an array of incentives to win business.

Boies Schiller Flexner LLP and home borrowers across multiple states, supported by that data analysis, subsequently filed a national class-action lawsuit against UWM alleging a Racketeer Influenced and Corrupt Organizations Act (RICO) “scheme to defraud” and “cheat hundreds of thousands of borrowers out of billions of dollars in excess fees and costs that they paid to finance their homes.” UWM called the lawsuit a “sham.”

In the hours after Hunterbrook Media’s story was published, marketing from UWM — including a video claiming brokers shop between “dozens of options” and a Super Bowl ad — disappeared from UWM’s channels.

Now Hunterbrook Media has learned that a UWM executive set up a shell company that in 2019 was used to purchase and establish UMortgage, a Philadelphia-based mortgage company that brands itself as independent, according to corporate records, some obtained through Freedom of Information Act, or FOIA, requests. UMortgage is run by Anthony Casa, a close ally of UWM CEO Mat Ishbia.

The financing via the shell company, which was owned by UWM Chief Strategy Officer Alex Elezaj until at least 2020, enabled Casa to buy UMortgage and become its CEO just two years after he exited personal bankruptcy. The nature of that financing relationship previously had been unknown.

UMortgage, which operates in 48 states and the District of Columbia, has since become a reliable funnel of loans to UWM — and one of the biggest mortgage originators in the country. In the last three years, UMortgage sent UWM an estimated 77% of its loans, totaling an estimated $1.9 billion, according to Hunterbrook Media’s analysis of 2021, 2022, and 2023 county and federal-level mortgage data.

A former branch manager and senior loan originator for UMortgage, Lyndsey Johnson, claims that UMortgage leadership regularly manipulates its rate sheets to make UWM’s loans appear cheaper than those from other lenders — without telling the UMortgage loan originators whose responsibility it is to shop for the best deal on behalf of clients.

Asked about her claim, UMortgage and Anthony Casa did not respond to a request for comment.

Ishbia and Casa are well-known in the mortgage industry for an entwined history since they reportedly met in 2015. UWM was a major financial sponsor for an upstart industry group, the nonprofit Association of Independent Mortgage Experts, or AIME, that was started by Casa in 2018, in part to challenge the incumbent trade association, the National Association of Mortgage Brokers.

Casa, the son of a boxer, became known for a pugnacious leadership style. He ultimately resigned from his position at AIME after a lawsuit revealed he had made vulgar comments about the wife of an executive at Rocket, UWM’s biggest rival. The Casa scandal led many of AIME’s lender partners to flee. Not UWM, which remains an AIME title sponsor.

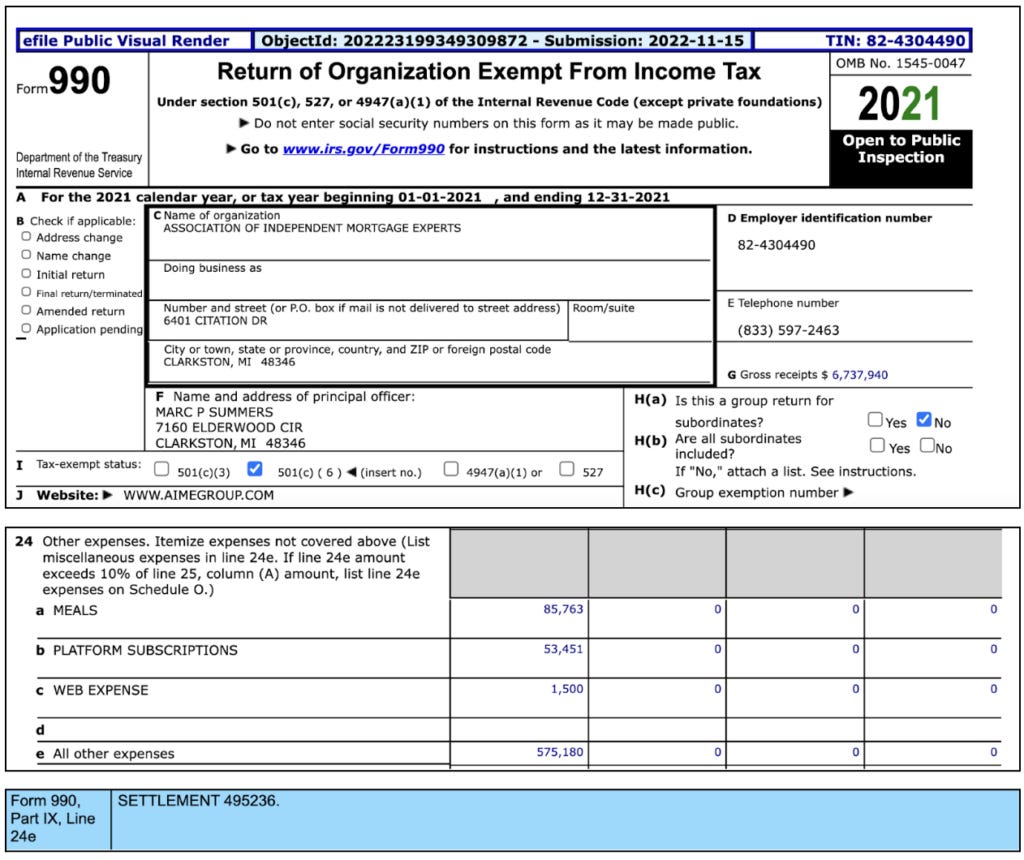

Shortly after Casa stepped down, AIME, a 501c(3) nonprofit, reported an unspecified $500,000 settlement payment, according to tax filings seen by Hunterbrook Media.

Andy Harris — an Oregon mortgage broker who was an executive director at NAMB — argues that the relationship between UMortgage and UWM runs afoul of mortgage regulations like the Truth in Lending Act (TILA) and the Real Estate Settlement Procedures Act (RESPA), based on records he says he has seen. After stepping down from NAMB, Harris says he spoke at panels for AIME before becoming disenchanted and publicly opposing the group.

TILA requires clear disclosure of mortgage terms and costs — and bans both lenders and brokers from steering borrowers into higher-cost loans when they qualify for more affordable options. RESPA prohibits kickbacks, referral fees, and undisclosed affiliated business arrangements between mortgage brokers and lenders.

The Dodd-Frank Wall Street Reform and Consumer Protection Act, passed after the 2008 financial crisis, strengthened both RESPA and TILA — with the goal of ensuring lenders and brokers would act in the interests of homebuyers. It also created the Consumer Financial Protection Bureau, an independent bureau within the Federal Reserve charged with monitoring and tightening consumer protections on financial markets, including the mortgage industry.

To date, neither UMortgage nor UWM have faced public regulatory scrutiny as a result of their relationship.

“The whole thing was collusion,” said Harris, who had sent business to UWM as an independent mortgage broker before the company “turned to the dark side.”

“The regulators failed us miserably,” Harris added.

UWM, Casa, Elezaj, and UMortgage did not answer Hunterbrook Media’s questions. A lawyer for UWM said the company would “not respond” and called Hunterbrook Media’s questions “uneducated inquiries.”

The Paper Trail: How UWM leadership helped Anthony Casa go from bankruptcy to billions in originations

In the early 2010s, living in a suburb of Philadelphia and working for a modest mortgage lender called Garden State Home Loans, Casa was struggling with money, after a custody dispute with his ex-wife, police records show.

On one occasion, police were called by a garage-door installer who complained that a check from Casa had bounced and that he subsequently was dodging payment. Casa told police he was having money problems, according to records.

Around that same time, Casa’s ex-wife, with whom he shared a then 3-year-old son, claimed in police reports that he was denying her visitation unless she paid him. At one point, Casa was arrested when he took his son out of state. Records show no convictions, and it is unclear how those incidents were resolved.

What is clear is that he filed for personal bankruptcy in 2012, beset by $410,000 worth of debt on his house worth only $250,000, $180,000 of unpaid taxes dating back several years, and various other payments owed.

Casa was put on a $124 per month payment plan to be paid over four and a half years. He also lost his house. In 2017, the case was resolved.

Just two years after that, in 2019, Casa contributed at least $300,000 to a shell company called ECWIN, LLC., which bought the entity that would later be renamed UMortgage from its prior owner, Suzanne Okun. (Okun had previously worked as a consultant for Shore Mortgage, as UWM was previously known, and reportedly has other ties to UWM.)

Asked how he came upon the money to start UMortgage, Casa did not reply.

Casa wasn’t the only owner of ECWIN, according to documents obtained via FOIA and reviewed by Hunterbrook Media. The second was Elezaj, the chief strategy officer and a board member of UWM, who infused $300,000 into the company through a trust on the eve of its purchase of UMortgage, according to disclosures made to state mortgage regulators and in a document obtained via FOIA and seen by Hunterbrook Media.

Top: Balance Sheet of ECWIN LLC as of December 31, 2020, signature page from Assignment of Interest pursuant to which Elezaj transferred certain ownership interests in ECWIN LLC to Casa. Bottom: Ownership Structure of UMortgage LLC f/k/a Premier Processing LLC, as disclosed to state mortgage regulators and in a document requested via FOIA and seen by Hunterbrook Media.

Legal work related to the transfer of ownership from Okun to Casa and Elezaj was conducted by Ishbia & Gagleard, P.C., a law firm owned by Jeffrey Ishbia, UWM’s founder and a board member (and Mat’s father).

Letter from Ishbia & Gagleard, P.C., transmitting documents evidencing a transfer of ownership in UMortgage from Suzanne Okun to ECWIN, LLC.

Elezaj appeared on UMortgage filings until 2020 — when it appears he transferred his stake to Casa, just before UWM’s public listing through a SPAC transaction.

How UMortgage allegedly “manipulates” rate sheets and sends business to UWM

UMortgage says it operates like a “broker” on the front page of its website. But the company also acts as what is known as a mini-correspondent or non-delegated correspondent lender, according to Johnson and confirmed by deeds of trust filed in various counties.

That means, rather than simply serving as a conduit to wholesale lenders such as UWM, like other independent mortgage brokers, UMortgage also funds loans through its own warehouse facility — a line of credit — with a bigger lender like UWM responsible for the underwriting, according to deeds of trust reviewed by Hunterbrook Media.

Mini-correspondent lenders do not have to disclose broker fees to homebuyers the same way brokers do, and have more control over their margins.

In 2014, the Consumer Financial Protection Bureau said “that some mortgage brokers may be shifting to the mini-correspondent model under the mistaken belief that identifying themselves as such would automatically exempt them from important consumer protection rules affecting broker compensation.”

“Today we are putting companies on notice that they cannot avoid those rules by calling themselves by a different name,” the CFPB said. In the 10 years since the announcement, Hunterbrook Media has not been able to identify any CFPB- enforcement action against mini-correspondent lenders for the issues described in the guidance.

According to Johnson, UMortgage often charges more in upfront fees than a traditional broker — and pushes homebuyers to UWM over other lenders.

The way this worked, Johnson claimed, was simple: UMortgage would add 100-basis-point “negative price adjustments” to other lenders “in the back end” of the software its loan officers used to compare lender offers. That way, she claimed, “UWM would show up at the top of the rate sheet.”

“UMortgage advertises to borrowers, and loan originators, that they have multiple wholesalers with competitive rates and fees that are transparent,” Johnson said. “In reality, loan originators are deceived and restricted by price adjustments they don’t know about.”

When Johnson confronted her UMortgage management about this, she received an email back saying: “You are exactly right,” according to what she says is a screenshot she included in her Facebook video. Johnson said she got the impression that UMortgage “didn’t really care about the borrower.”

Another mortgage veteran who worked for UMortgage, but asked not to be named out of fear of being “blacklisted by the industry,” said she had a similar view of the company’s perspective on homebuyers. “It really wasn’t about truly helping borrowers or consumers,” she said.

Such alleged conduct could amount to “steering ” under the Loan Originator Compensation Requirements of TILA, according to Harris, if UMortgage is, in fact, not a bona fide lender and is “varying loan terms” to increase broker company or loan officer compensation to the detriment of the consumer. The mortgage industry veteran who asked to stay anonymous said altering rates is not uncommon in the mini-correspondent channel.

“He was just a front man.”

When Anthony Casa founded AIME, with the help of UWM’s capital, the stated idea behind the organization was to “protect independent mortgage brokers,” as its mission statement reads. NAMB, the original industry group, had become “a puppet of the lenders,” according to Casa. AIME’s messaging said that it was to put brokers first. And Casa led a vocal open campaign against NAMB, which drew wide attention in the industry.

Evan Wade, a mortgage technology executive who had been involved in an initial, abandoned attempt to launch UMortgage by Casa, according to public documents, has told a different story.

In a post to the same Facebook group of mortgage brokers in which Johnson’s videos were shared, Wade wrote: “The vision behind AIME from its earliest days was to funnel business to both UWM and a ‘brokerage’ controlled by Anthony Casa.” (Prior to starting AIME, Casa had been working for a company licensed primarily as a lender, but started UMortgage shortly thereafter.)

“He was just a front man,” said Harris, who said he left the board of NAMB in 2018 due in part to the encroachment of bankers on the organization. Harris said he attended some of AIME’s events, spoke on panels, and bought into its stated mission of putting brokers first — but eventually, he “started connecting the dots” and realized UWM was running the show, a relationship that has been detailed in a wide range of reporting over the years.

“Mat [Ishbia] controlled this whole thing,” Harris said, adding: “I never thought people would be this easily manipulated and then I learned how stupid they are.” AIME, he said, “is the largest attack on independent origination and small businesses across the country in history,” because of how it has led to the rise of megabrokers like UMortgage sending almost all of their business to UWM.

In 2020, Casa stepped down from AIME — after the Rocket executive whose wife he had insulted sued him for defamation. In videos included as evidence, Casa claimed that the woman had dated UWM’s Ishbia in college, saying, “It’s amazing that that’s the girl that sucked Ishbia’s dick in college.”

According to her lawyer, the woman was 11 years old during the time that Ishbia was in college.

The year after Casa stepped down from AIME, in 2021, the nonprofit made an unspecified $495,000 settlement payment, according to Hunterbrook Media’s review of AIME’s tax filings. Asked if the settlement was related to Casa’s statements, AIME did not respond.

Since stepping down from AIME, Casa has continued as the CEO of UMortgage and maintained a close relationship with Ishbia. At a November 2021 UMortgage team meeting, broadcast on Facebook Live, Ishbia told participants that UMortgage was “one of the fastest -growing mortgage companies out there.”

“Soon,” Ishbia added, UMortgage would be “one of the biggest, if not the biggest, mortgage company in America, from a mortgage broker perspective.”

The following year, in a leaked voicemail left for Casa that was published as part of Hunterbrook Media’s first story, Ishbia can be heard sharing his affection for Casa and allegedly boasting of UWM’s ascendance in its industry over arch-rival Rocket, which it had just passed in loan originations.

“We fucking took those cocksuckers down,” Ishbia told Casa. “UWM is number one. You’re number one. We’re all number one together. And fuck them, I hate them with all my heart, and we’re gonna keep kicking their ass every fucking day,” he continued, before adding: “I love you, man.”

Complicating matters further, ARIVE, the loan origination software UMortgage allegedly used to make UWM look cheaper than competitors, was originally controlled by a holding company called Icwin, before later being sold, according to an application for authority to transact business in the state of Utah reviewed by Hunterbrook Media.

The President of Icwin was Anthony Casa, according to another document reviewed by Hunterbrook Media.

Ishbia was an ARIVE booster as well, posting videos to social media encouraging brokers to sign up for it.

“You can guess what the I and the C stands for,” wrote Wade, who claimed to be “employee #1 of the original ARIVE” in the same social media post where he shared the alleged origins of AIME.

When asked if he owned Icwin with Casa, Ishbia declined to comment.

Matthew Termine is a lawyer with nearly five years of experience leading the legal team at a mortgage technology company, before he left the industry earlier this year. In 2017, Matt’s reporting was credited by the Wall Street Journal, among others, for identifying suspicious mortgage loan transactions that led to several successful criminal prosecutions, including that of a prominent political operative and the chief executive officer of a federally-chartered bank. He is a graduate of Trinity College and Fordham University School of Law. He grew up in Old Saybrook, Connecticut and now lives in Brooklyn with his wife and two sons.

Hunterbrook Advisor Matt Murray, the former Editor-in-Chief of the Wall Street Journal, contributed editing. Hunterbrook also enlisted external fact-checking and copy editing support.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.