Breaking: Teradyne Tapped For Amazon’s Breakthrough Robot

How the semiconductor testing giant Teradyne turned itself into a robotics pick-and-shovel play that landed a potentially catalytic contract with Amazon.

By: Sam Koppelman

Editor: Jim Impoco

Based on Hunterbrook Media’s reporting, Hunterbrook Capital is long Teradyne ($TER) at the time of publication. Positions may change at any time. See website for full disclosures.

This breaking news scoop is a collaboration between Hunterbrook Media and Citrini Research, a leading thematic equity research firm.

ICYMI: Earlier this week, Hunterbrook — in partnership with IPHR and NAKO — published an investigation into how Western tech powers Russia’s war against Ukranian civilians. Read it here.

Robots can finally feel — not in their hearts, at least not yet, but in their limbs.

That is what Amazon has claimed about its new warehouse robot, Vulcan, which the tech giant says represents a “step change” breakthrough in automation and a “fundamental leap forward in robotics.” Forget the “numb and dumb” machines of yore, says Amazon ($AMZN), because the Vulcan is the first robot in its history with a “sense of touch.”

This, the company claims, enables the Vulcan to perform two tasks previously thought to be among the hardest to automate: “picking” (grabbing items from shelves to fulfill orders) and “stowing” (placing inventory into bins). And the Vulcan can do it, Amazon says, “at speeds comparable to that of our front-line employees.”

(When asked whether this will automate said employees, of course, Amazon does the old dodge, duck, dip, dive, and dodge, claiming that the robots and the humans will be collaborative.)

Since Amazon debuted it in May, the Vulcan has been featured in the Wall Street Journal — and it was the subject of a 12-minute segment on CNBC, framed as a breakthrough for Amazon. It’s “a technology that three years ago seemed impossible but is now set to help transform our operations,” said Aaron Parness, Amazon’s director of applied science.

But here’s what the media doesn’t seem to have reported — and what Amazon hasn’t mentioned: Another company actually supplies the Vulcan robot’s arms.

A closer look by Hunterbrook Media, in partnership with Citrini Research, reveals that Vulcan’s distinctive robotic limbs come from Teradyne ($TER). The limbs are made by Universal Robots, a Danish collaborative robot (read: “cobot”) manufacturer purchased by Teradyne for $285 million in cash in 2015.

In a note to clients, UBS identified Teradyne’s role as a potential supplier of the Vulcan, but apparently nobody picked up the story.1

Teradyne’s robotics division, which includes Universal Robots and Mobile Industrial Robots (MiR), represents about 10%-15% of the semiconductor testing giant’s revenue. With Amazon planning to automate up to 80% of its 14 billion items stowed by hand annually, some quick math points to a rough estimate of a $400 million payday for Teradyne — which could also put Universal Robots on the map for other industrial giants.2

The revelation about Amazon’s supplier comes at a pivotal time for the robotics sector. As Citrini Research recently documented in a comprehensive primer on the sector, three factors are converging for the industry: 1) The cost curve for robots is collapsing; 2) AI, specifically vision-language-action models, has finally given robots a brain worth powering; and 3) Key suppliers, like Teradyne, are trading at cyclical trough valuations.

Citrini points out that the Vulcan “would have been impossible to deploy 2-3 years ago but advancements in visual-language-action models have resulted in the ability of the arm to think in 3 dimensions and differentiate non-uniform items with multiple surfaces in a manner that can assess the force necessary and avoid damaging goods. If you’re shipping a Fabergé egg, you need the robot to handle it differently than a tungsten cube.”

Helping fuel the industry’s recent takeoff are NVIDIA’s Isaac Sim platform and GR00T models, which enable robots to learn tasks exponentially quicker than they otherwise would have. Teradyne has integrated the technology directly into Universal Robots’ arms through an ongoing partnership with Nvidia.

The collaboration, which Nvidia posted about on its website as recently as late June, enables path planning that the companies claim is 50 to 80 times faster than traditional approaches. It “helps set a new standard for industrial automation,” wrote Nvidia.

Nvidia’s technology also allows robots to adapt to dynamic environments in real time — environments, it seems, like Amazon warehouses, which are “on the cusp of using more robots than humans” for the first time, according to the Journal article from earlier this month.

And for Amazon, the Vulcan appears to represent a fundamental change in its understanding of what it is possible for robots to do.

In his interview with CNBC, Parness — the Amazon applied science director who previously worked at NASA’s Jet Propulsion Laboratory — said he initially didn’t buy that it could work.

“There was a recent Ph.D. graduate who was trying to get the robot to stow items into the fabric pods. My first impression was, ‘Oh, how naive — the real world is going to teach this new grad that robots can’t do these things,’” said Parness.

Then he saw the technology in action.

“I had this pivot from, ah, this is never going to work to, oh my gosh, this is the future.”

Receipts

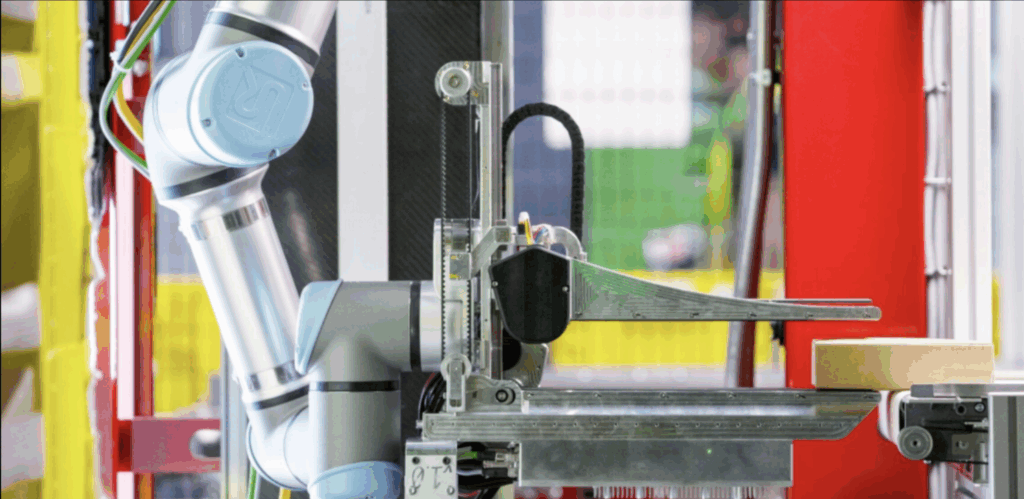

See this photo from Amazon’s press release on Vulcan?

The arm has the trademark design of Universal Robots cobots — a sleek silver frame with blue joint caps.

Zoom in and you’ll see a label, which clearly says “Universal Robots.”

The arm itself is also emblazoned with the company’s “UR” logo — across various Amazon promotional materials and videos.

At the end of the arm is a gripper, which provides yet more evidence that the Vulcan was built specifically for Universal Robots.

The gripper is labeled with the name “Robotiq,” according to a video on Amazon’s website.

Robotiq is designed to be compatible with Universal Robots, including the precise arm used by Amazon’s Vulcan.

Oh, and this may be a coincidence, but look where Teradyne HQ and Amazon Robotics are located:

We visited the complex where both companies are based and found a Teradyne truck about 20 feet from the entrance to Amazon Robotics. Probably nothing.

Teradyne’s shares have slumped during a business cycle downturn in its main businesses. With earnings coming up later in July, however, this is looking like the first quarter in which the company’s insiders haven’t sold a single share … since 2018.

Asked if the Vulcan deal had anything to do with its insiders HODLing, Teradyne did not reply to Hunterbrook Media’s request for comment. Neither did Amazon.

We sent this scoop over to the Citrini Research team, which has been doing deep reporting on the rise of humanoid robots. Read their full analysis of the deal — how big it might be and what it might mean for Teradyne’s valuation — here.

Author

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets — and occasionally volunteers on a fire speech for a good cause. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Editor

Jim Impoco is the award-winning former editor-in-chief of Newsweek who returned the publication to print in 2014. Before that, he was executive editor at Thomson Reuters Digital, Sunday Business Editor at The New York Times, and Assistant Managing Editor at Fortune. Jim, who started his journalism career as a Tokyo-based reporter for The Associated Press and U.S. News & World Report, has a Master’s in Chinese and Japanese History from the University of California at Berkeley.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

Please contact ideas@hntrbrk.com to share ideas, talent@hntrbrk.com for work opportunities, and press@hntrbrk.com for media inquiries.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided "as is" without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.

An interesting tidbit from UBS: “Our conversations with the company this week confirmed that Vulcan could represent the first tangible outcome of TER's strategy to engage more directly with large OEMs (as announced in late 2023). This has already sparked interest from additional customers, potentially marking a turning point for TER's industrial automation (IA) business. The company was clear that contributions are still very limited this year, as Vulcan is still in pilot and IA demand (especially in Europe) remains under pressure.”

This number is based on napkin math — assuming the Vulcan takes care of 80% of the 14 billion items stowed by hand annually at the stated rate of 20 hours per day; and assuming two UR arms per Vulcan, as has publicly been reported, each of which costs around $50,000, plus servicing fees. (Certain napkin math can get you to a way higher number — but we discount to arrive at $400 million. It’s also totally possible, at some point, Amazon could switch away from UR and replace them with their own internally built hardware.) So, a much lower number is possible too.