EXCLUSIVE: Exxon Spinout Sable Leaked Key Info To Investors Including Golfer Phil Mickelson

"An announcement is coming after market close today."

By: Sam Koppelman, Till Daldrup

Editor: Jim Impoco

Hunterbrook Media’s investment affiliate, Hunterbrook Capital, does not have any positions related to this article at the time of publication. Positions may change at any time. Full disclosures below.

On a leaked call, Sable Offshore CEO Jim Flores told a select group of investors in October that the company would likely have to raise up to $200 million in equity by the end of 2025. The company had not disclosed this dilutive equity offering publicly.

It’s one of several examples of apparently selective disclosure from Sable. The company seems to have shared information only with certain investors, a list that includes golfer Phil Mickelson, according to messages from a group chat leaked to Hunterbrook.

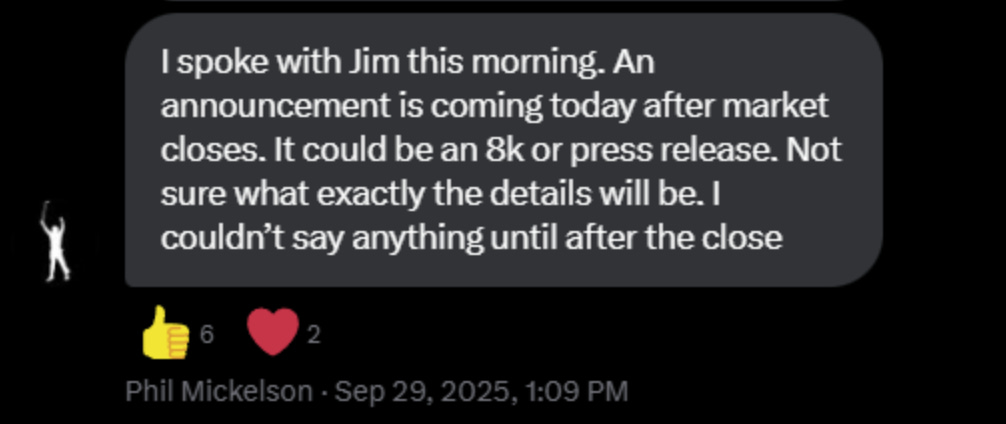

In one of those messages, Mickelson passed on a tip allegedly from the company’s CEO in an X group chat that Sable would be issuing an 8-K filing about a material update later that day. Sable did in fact issue a market-moving 8-K shortly thereafter.

“I believe this beyond any doubt: These guys definitely have first hand communication from Jim and they are being fed information from Jim and giving it to other group members,” one member of the chat, who previously owned the stock, told Hunterbrook, in reference to some of his fellow group chat members.

Whether that material information was actually worth having is another question. While Sable’s stock rose 8% after hours on the day the 8-K was issued, it gave that all back (and then some) the following trading day. Meanwhile, courts, regulators, and activists have so far stopped Sable from utilizing its sole asset — a pipeline that in 2015 erupted into one of the worst oil spills in California history.

Mickelson declined to comment directly to Hunterbrook despite repeated outreach. In a message to the group chat, which is called “Sable Quantum Offshore Compute,” he warned that Hunterbrook was “looking into this chat as if we have inside info.”

“What’s funny about it is we’ve all been wrong on just about everything and we’ve all lost money but whatever,” Mickelson added, before posting a phone number of a Hunterbrook reporter to the chat. (Another group member then attempted to dox the reporter in a Craigslist post offering free dog food, apparently not realizing that Hunterbrook was still reading their messages. Lol.)

On Wednesday, an anonymous X account posted a very short excerpt from the same call with investors obtained by Hunterbrook. Soon thereafter, a member of Mickelson’s chat relayed to the group that the company had contacted them claiming that the audio was AI generated, and asking investors to push back against an anticipated Bloomberg News article on Sable’s conduct. Within hours, a chorus of Sable investors, including Mickelson, was repeating that message on social media.

In response to questions about this, Sable told Hunterbrook that “based upon information provided to us we believe that the alleged recording was either AI generated or otherwise altered.”

The company did not respond to follow up questions regarding what led it to that belief, or what portions of the recording it believed had been altered. At Hunterbrook’s request, a leading AI detection company ran the recording through their platform and concluded that it is likely not to be manipulated using generative artificial intelligence in any way. Hunterbrook also asked a senior AI engineer at a top research lab to analyze the recording; he also confirmed that it was highly unlikely to be AI generated or altered. The recording Hunterbrook obtained includes the short excerpt that was posted on X, though the version on X sounds distorted.

Perhaps the most notable part of the call comes toward the end — when Flores lays out his Hail Mary plan to bring his project online: Enlisting President Trump and Commerce Secretary Howard Lutnick to avoid California regulations and secure federal funding for the project.

A carrot Sable is prepared to offer, according to the recording? A round of golf with “a certain lefty.”

A source close to Lutnick told Hunterbrook: “He’s never heard of the company and has no plans to golf with Mickelson.”

The leaked audio recording of the video conference begins with a familiar lament: “Every time I open this thing up, it’s got a different set of instructions,” says an individual identified by sources as Sable Offshore’s chief executive Jim Flores, noting the “anxiety” of logging onto platforms like Zoom and Teams.

That’s about the only normal moment on the call, in which Flores ultimately tells a small group of investors the company would likely need to raise as much as $200 million in equity within weeks, information he hadn’t disclosed to the general public. Issuing new equity would dilute the value of existing shareholder’s stock.

When one participant on the call suggested that it would be in investors’ interest for the stock price to be as high as possible when the equity was raised, Flores acknowledged that the company was “doing everything we can” to make that happen. Another participant noted that the company might be “able to announce the debt financing first for the package with the government, which will get the stock price up and then raise the equity.”

Almost as an afterthought, he or someone else on the call adds “without seeming overly manipulative.”

It was not immediately clear whether the individuals suggesting this plan were investors or Sable executives.

After those comments, Flores pivoted to discussing whether getting approval for debt financing from the federal government was feasible during the ongoing shutdown.

The audio clip — which Hunterbrook obtained from a third party who claimed not to be on the call himself — offers a rare window into how a struggling public company has navigated the tension between needing capital and avoiding further dilution, while sharing potentially material information with a handpicked investor group.

Hunterbook has obtained evidence indicating that Sable also may have shared material information with professional golfer Phil Mickelson, who in addition to being a shareholder, has become one of the most vocal Sable boosters, with posts on X calling on California officials to meet with him and “enable Sable.”1

Mickelson is also in a private group chat with select Sable investors, with whom he has shared insights from his conversations with the company’s CEO.

“The CEO Jim Flores and I are both on the same board of another company,” Mickelson wrote in a now-deleted X post, explaining one possible origin story of their relationship. That company seems to be Intrepid Investment Management, which listed both men on its advisory board as recently as January. Mickelson has since been removed from the page.

In 2016, Mickelson paid the Securities and Exchange Commission more than $1 million to settle allegations he traded on inside information — after receiving tips about a public company from Billy Walters, dubbed the “world’s most successful sports bettor.” Walters was sentenced to five years in federal prison but ultimately did not serve the full sentence. In the waning hours of President Trump’s first term, Walters, who was found guilty of making more than $40 million in illicit profits over six years of trading, secured a commutation.

About a decade after the SEC settlement, as the six-time major champion actively promoted Sable’s stock on social media across over a hundred posts on X, he was also allegedly speaking directly with Flores about regulatory approvals and company strategy, according to the private messages reviewed by Hunterbrook.

“I spoke to Jim this morning. An announcement is coming today after market closes. It could be an 8K or press release,” Mickelson wrote to a group of Sable investors, in one example, on September 29.

Later that afternoon, just after 5pm, Sable filed the 8-K — a form companies use to disclose material events to the public — disclosing its new strategy to circumvent California regulators.

The stock initially shot up 8% in after-hours trading after the news, before closing down the following day.

“Usually an 8-K is a release of material information,” said Adam Badawi, a securities law professor at the University of Berkeley. “And so, if you know about the release of potential material information before it’s released to the general public, that’s generally going to be material non-public information.”

“It could be a potential Reg FD violation” by the company, he added, referring to the SEC rule that prohibits public companies from making selective disclosures of insider information to certain individuals, such as analysts or investors, before disclosing it to the general public. “It sounds like material information. And if you’re sharing it to a subset of people outside, that is the kind of thing you should be sharing publicly.”

This incident wasn’t necessarily an aberration.

“I believe this beyond any doubt: These guys definitely have first hand communication from Jim and they are being fed information from Jim and giving it to other group members. There is a hierarchy to the insiders,” a member of the chat opined to Hunterbrook, referring to certain other members of the group whom he did not name. “There are people that are very close to Jim and Jim is giving real information to. Then there’s people that think they’re close to Jim who he is giving fraudulent information to.”

(Asked when he sold his Sable shares, the source explained: “There comes a point after the fourth fraudulent 8-K where you realize this company isn’t what it says.” While Hunterbrook is not aware of any conclusive finding that the company has engaged in fraud, and believes the source was speaking figuratively, the company is facing at least one lawsuit making such allegations.)

Numerous messages from recent months reviewed by Hunterbrook show Mickelson claiming to have frequently communicated with Flores, receiving details about company developments from the CEO — whom he sometimes called “BJF” for “Big Jim Flores.”

The leaked call and messages raise questions about the selective disclosure of material nonpublic information at a company racing against a March 1, 2026, deadline. If Sable doesn’t restart production by then, its only asset — three offshore oil platforms and an aging pipeline responsible for one of California’s worst oil spills — reverts to Exxon Mobil without compensation, unless Exxon extends the terms of its loan.

The company’s struggles have intensified in recent months. After Sable told shareholders it had completed pipeline repairs — a claim that helped its stock soar in May — California’s fire marshal said in October that more work was required. California officials have filed criminal charges against the company and its executives, an act Sable in turn called “politically motivated.”

The stock, which briefly traded above $35 earlier this year, has fallen more than 60% and now hovers around $13 as of this writing. Several legal setbacks and regulatory denials have shareholders fearful, according to screenshots.

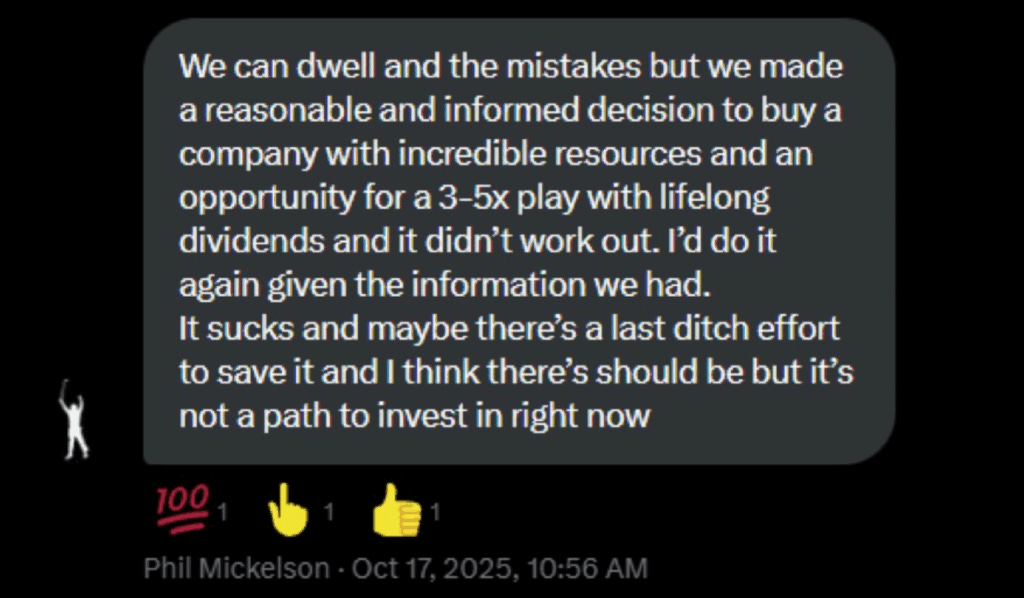

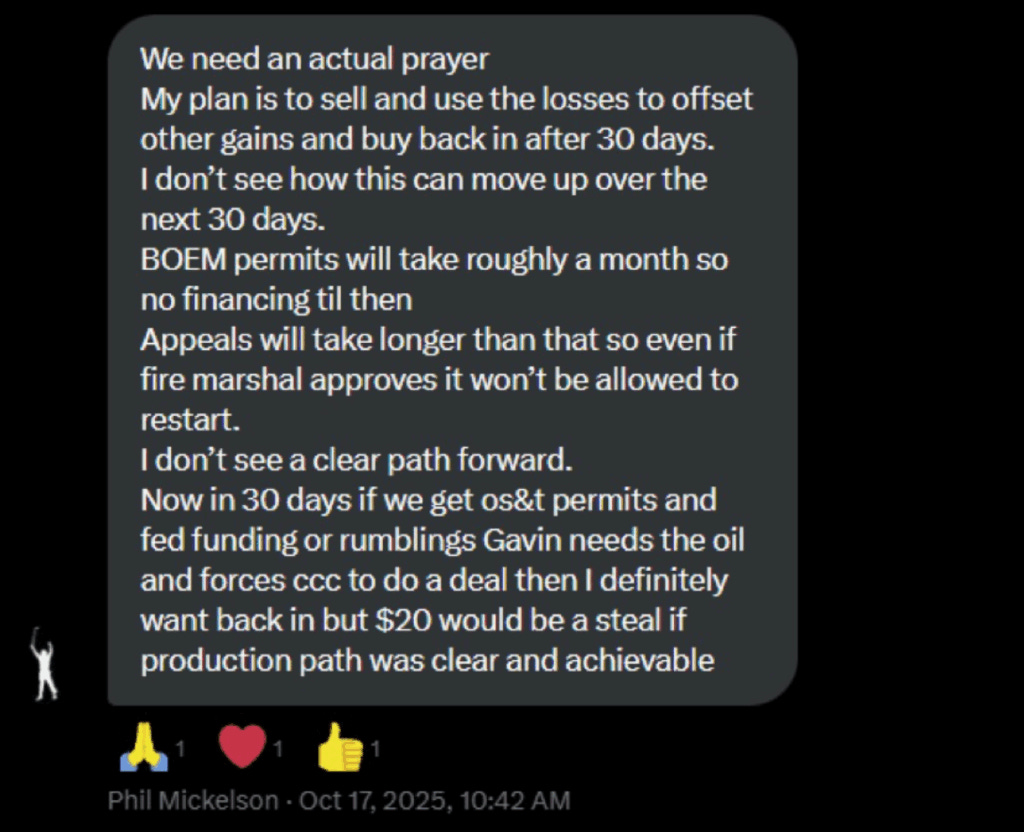

“We need an actual prayer,” Mickelson writes in one, admitting he planned to sell shares “I don’t see a clear path forward.” In another, he writes: “I’m very defeated right now.” In a third, he says: “I’d do it again given the information we had. It sucks and maybe there’s a last ditch effort to save it and I think there’s should be but it’s not a path to invest in right now.”

But after selling his shares, Mickelson, who has a documented history of gambling addiction, wrote in a message that he bought them back — in part because there is now a Hail Mary path Mickelson seems to believe the company should pursue: convincing President Donald Trump to circumvent California Governor Gavin Newsom by funding an effort to run the project entirely in federal waters. Instead of pumping oil through the California pipeline, Sable would ship it around the world from a storage vessel off the coast.

This, Mickelson seems to believe according to the messages, could work — or, at the very least, buoy what remains of his investment. Trump confronting Newsom, Mickelson predicted (in more colorful language), could “drive up any stock.”

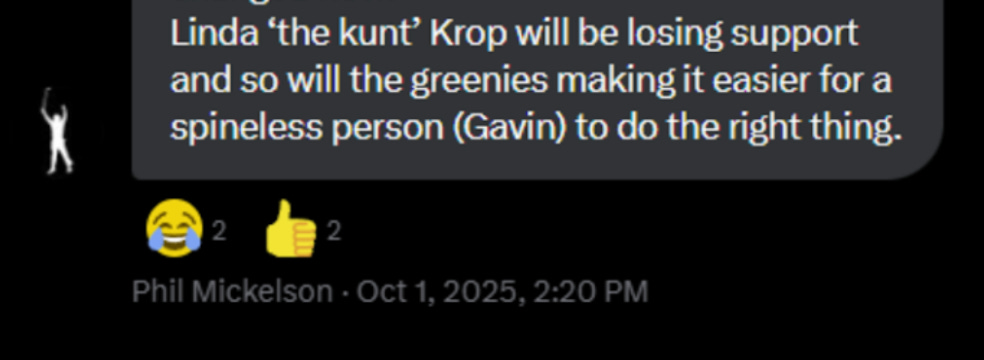

While waiting on the federal government, Mickelson has been taking his anger out at California elected officials and environmentalists — including Environmental Defense Center environmental lawyer Linda Krop, an advocate against the project, whom Mickelson referred to as “Linda ‘the kunt’ Krop.”

In a comment to Hunterbrook, Krop said: “This isn’t about me. It’s about a company that can’t get it together to operate responsibly and is now being charged with felonies for its illegal activities, in addition to a state attorney general enforcement lawsuit, a maximum $18 million fine, and multiple injunctions preventing repairs and restart.”

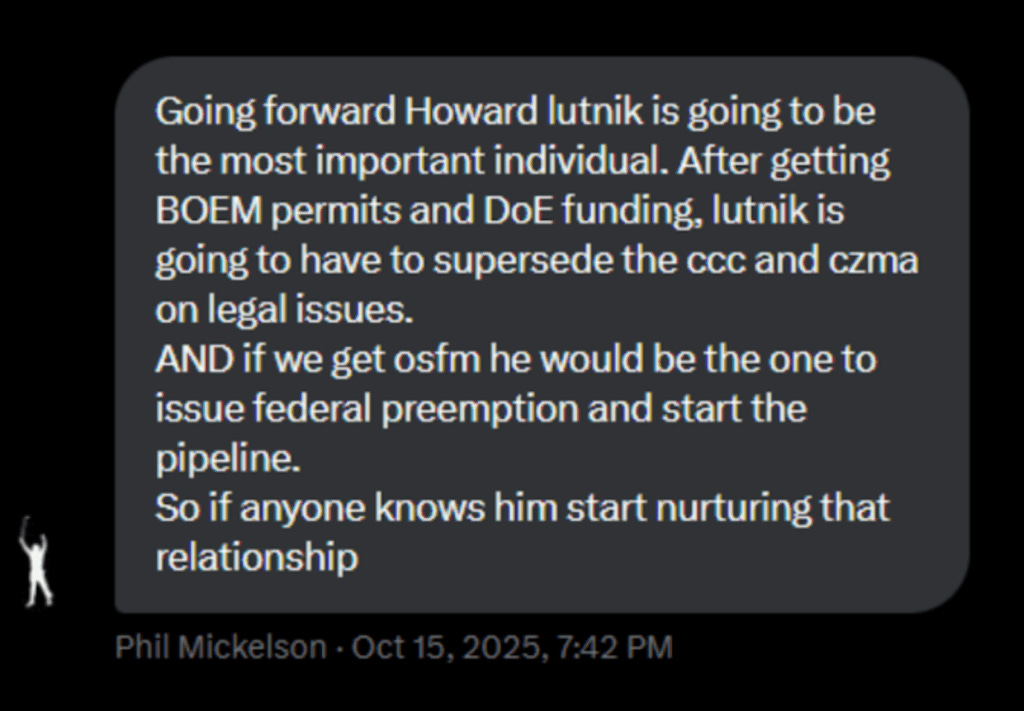

The exact plan for how Sable Offshore plans to be saved by the federal government appears unclear — and, at this point, largely improvisational. “Going forward Howard lutnik [sic] is going to be the most important individual,” Mickelson wrote of the Commerce Secretary on October 15. “So if anyone knows him start nurturing that relationship.”

Lutnick came up again in the leaked audio file. “I’ve got a certain golf buddy that’s in the Commerce Department, all the way at the top,” said one of the participants. “I’ve had to promise Lutnick a golf game on the West Coast with a certain left hander,” Flores responded, in an apparent reference to Mickelson.

A source close to Lutnick told Hunterbrook: “He’s never heard of the company and has no plans to golf with Mickelson.”

Flores cited ties with Energy Secretary Chris Wright as well and claimed to have reached Trump through an intermediary.

“DJT,” as Flores called him, had supposedly heard about a proposal to rename the Pacific Ocean as “Ocean America.”

“He liked it too much,” Flores said of the name, according to an alleged source of Flores’ who had spoken with Trump about Sable. “So if you hear Ocean America,” Flores told the investors, “that’s where it came from.”

Flores added that he had told his source to tell Trump that he would “put some gold leaf on the platforms.” The platform would also, apparently, boast Trump’s name. “We need to know whether we need to paint the letters 50 feet tall or 70 feet tall,” Flores said, “so we make sure Oprah can see the tanker from her Montecito mansion.”

On the call, Flores claims the message was indeed passed to Trump. Predictably, Flores said: “He liked it in gold.”

Sable Offshore: A Pipe Dream?

The oil came ashore slowly — and then all at once.

On May 19, 2015, a corroded pipeline ruptured beneath the California coast and released more than 120,000 gallons of crude, large amounts of which ended up in the Pacific Ocean. By the time workers shut down the flow, oil had contaminated 3,700 acres of Santa Barbara beaches and fisheries — the state’s worst spill in a quarter century. Photos showed pelicans caked in black sludge. Refugio State Beach, a pristine stretch of coastline, looked like a disaster zone.

Federal investigators found that the company behind the pipeline had failed to prevent the corrosion and missed warning signs that could have stopped the rupture. A jury convicted the company on nine criminal counts. The pipeline company, Plains, was ordered to pay more than $305 million in settlements and penalties.

The pipeline had been carrying oil from three offshore platforms called the Santa Ynez Unit, owned by Exxon Mobil. After the spill, California tightened regulations on coastal pipelines. Plains agreed to enhanced oversight. And Exxon began the long process of trying to bring Santa Ynez back online.

Seven years later, Exxon gave up. The oil giant had tried three different restart plans — retrofitting old pipes, trucking oil onshore, everything short of reinventing the wheel. Nothing worked. California officials remained skeptical that the aging infrastructure could operate safely. In early 2024, Exxon wrote down the value of Santa Ynez by more than $2 billion and blamed “continuing challenges in the state regulatory environment.”

That’s when Flores saw an opportunity.

As Hunterbrook wrote in April 2024, Flores is an industry veteran — best known for his tenure running Freeport McMoRan’s oil and gas division. He was ultimately replaced amid billions in losses and writedowns.

Sable Permian Resources, Flores’ next act, went bankrupt in 2020 after three years of operation. Tom Loughrey, who analyzed distressed credit in the oil and gas sector at the time, told Hunterbrook that Sable Permian “was poorly run” and “very scammy.”

Sable Offshore was supposed to be Flores’ comeback. In 2021, he formed a blank check SPAC. In 2022, he began pitching a takeover of Exxon’s project, projecting a restart within two years.

In February 2024, Flores closed the deal — paying $988 million for the Santa Ynez platforms and the pipeline, financed largely by a $625 million loan from Exxon itself. The Santa Ynez Unit became Sable’s only asset. The company went public on the New York Stock Exchange. And Flores told investors he could restart production in the third quarter of 2024, succeeding where Exxon had failed, and doing it in just eight months.

The catch? If Sable didn’t restart production by March 1, 2026, everything could revert to Exxon. No compensation. (That is, unless Exxon extends the term of the loan.)

At the time, Hunterbrook Media expressed skepticism, calling Sable a “speculative gamble at the mercy of California regulators, litigators, and communities” and predicting that the project would not “restart production at Santa Ynez on time, if at all.”

That prediction held: Sable kept moving its target restart date, from September 2024 to December 2024; then January of 2025; then February; and so on. It still hasn’t restarted.

But the idea of Sable, the age-old promise of pulling treasure out of the ocean, caught fire. The stock price kept soaring, with backing from investors ranging from one of the main characters from “The Big Short” and Himalaya Capital founder Li Lu to, eventually, Phil Mickelson.

At one point, the share price hit $35.

Then reality caught up. After losing several key rulings in court; being sued by the California Attorney General; and still not yet being approved by the Office of the State Fire Marshal, Sable stock has fallen over 50% in recent months.

One central issue: Sable had told the public it had completed all necessary repairs on its pipeline, including in a May 19 press release that sent the stock soaring. The claim about construction being finished was critical. It was the reason Sable claimed it could restart the project, despite a May 28 preliminary injunction against it from the California Coastal Commission, which had jurisdiction over the repairs. If repairs were not complete, the CCC’s injunction could prevent restart.

In an October letter to Sable, the Office of the State Fire Marshal explicitly said more repairs were required.

“I lost money. And without a doubt a lot of it was cause of miscommunication from management,” said one of the members of the group chat in an interview with Hunterbrook, citing specifically “the whole idea that the CCC case had no bearing over Fire Marshal approval.”

Amid the turmoil, and with Sable’s market cap falling precipitously, the loyal, tight-knit group of Sable backers began to wonder if they had been lied to by the company — or if California politics was just that unpredictable. And some started turning on each other.

Which is how Hunterbrook ended up with Phil Mickelson’s DMs.

The Capital Crunch

On the call, Flores appeared to outline over $2 billion Sable would need to execute its Plan B.

The money would fund: $900 million to buy out Exxon, $500 million for a vessel, $300 million for operations through early 2027, and $500 million in bonding. (A Reuters article from October 21 claimed sources cited $1.7 billion as the total cost.)

Some of the funding, Flores seemed to indicate, would come from the federal government.

“There’s a lot of money up there that’s being reprioritized toward hydrocarbon projects and away from the green like the solar panels,” Flores said of Trump administration energy programs.

Flores claimed — without substantiation — that Sable could employ a permit “still active” from the Exxon era. He said he expected regulatory clearance “before Thanksgiving” along with “an announcement out of one of the federal agencies on loan sponsorship,” though he also expressed concerns regarding whether this would be possible during a government shutdown.

The equity discussion began when an investor on the October call noted what Flores hadn’t focused on in his $2 billion financing overview: “I didn’t hear any equity in that scenario, and all I hear from people who are dumping the stock, shorting the stock, is equity is sorely needed here.”

Flores appeared to confirm the need: “We’re supposed to be on production in September, right? We’re not gonna be on production in September, so we’re gonna have to bridge a little to the financing. We’ll need some type of injection somewhere in the $100 to $150 to $200 million dollar range.”

The admission was notable because Sable hadn’t publicly disclosed plans for an imminent equity raise. And the timing was delicate: With the stock price depressed, selling new shares in a fundraise would heavily dilute existing shareholders — including Flores and other insiders.

Investors on the call pressed the point. “If the bridge or the patch is gonna be in a form of equity, the lower the stock price goes, the more dilutive it’s gonna be to the largest shareholders, i.e., you guys, the insiders,” one said.

Another asked directly whether Flores could do anything to boost the stock price before the raise — prompting Flores’ pledge to do “everything we can.”

Flores was also asked directly whether any company insiders would participate in a financing. “I think it would just show a lot of confidence,” said the investor. Flores replied: “I’m not that concerned about that, but there’s a lot of interest from everybody.”

Asked about timing, Flores suggested the equity raise would come “in the fourth quarter”— potentially within weeks of the late October call, before any promised federal approvals had materialized.

A person Flores introduces as “Greg” – likely Sable’s chief financial officer, Gregory Patrinely – tried to provide reassurance, noting the company has “$250 million unsecured investments” under its Exxon loan that could be tapped instead of selling equity. But he acknowledged a catch: Using that money requires Exxon’s consent, which is “in their sole discretion.”

Flores suggested the company is also working to add language to a federal spending bill blocking “any kind of legal or judicial or regulatory challenge” to the project.

When asked why Sable would even consider returning to California given the state’s opposition, Flores was blunt: “I’d much rather be offshore, but if they force me onshore… I’m gonna take it.”

Despite over a year of missed deadlines, Flores laid out another timeline on the call: close on the vessel by January, shipyard work through July, mobilization in August and September, production in the fourth quarter of 2026. “I’d be highly confident in a one-year span of getting on production,” he said.

In the meantime, Flores said he might seek an extension from Exxon as a contingency.

When asked why Exxon would agree, Flores relayed their supposed position: “They would not do what we’ve done. They’re not adept to operate in California because California moves the goalposts so bad, they cheat so bad.” He compared Exxon to “the red coats in the Revolutionary War — they march out with their coats on. We’ll follow the rules and the rules keep changing, and we’re more adaptable.”

An investor cut through the diplomacy: “ExxonMobil said fuck those Californians, I’d rather not be playing with them. Life’s too short for my career.”

“I get it,” Flores replied. “And they’re as elegant as you just said right there, I promise you.”

The ‘AI Generated’ Excuse — And the Group Chat Apparently Trying To Troll Hunterbrook While We Watched

When an excerpt of Sable’s investor call leaked online from an anonymous X account on Wednesday, Sable moved to discredit the clip.

According to screenshots reviewed by Hunterbrook, the company told a member of Mickelson’s investor group chat to spread the word that the recording was “AI generated,” as well as urging investors to proactively counter the narrative of an anticipated Bloomberg News article on the recording.

Within hours of the leak, Mickelson took to X to insist he knew Flores’ voice and shot back at the anonymous poster: “That is definitely not him.” Internally, the group chat seemed to be split on whether the recording was genuine.

In a statement to Hunterbrook, Sable claimed that “based upon information provided to us we believe that the alleged recording was either AI generated or otherwise altered.”

The company did not respond to follow up questions regarding what information had been provided to it that led it to that belief, or what portions of the recording it believed had been altered.

At Hunterbrook’s request, a leading AI detection company ran the recording through their platform and concluded that it is likely not to be manipulated using generative artificial intelligence in any way. Hunterbrook also asked a senior AI engineer at a top research lab to analyze the recording; he also confirmed that it was highly unlikely to be AI generated or altered. The recording provided to Hunterbrook includes the short excerpt that was posted on X, though the version on X sounds distorted.

A wide variety of factors supported the verisimilitude of the more than 35 minute long audio file.

Meanwhile, Sable apparently launched an effort to identify who leaked the tape, according to a source familiar with the matter, raising the postmodern question of why a company might target corporeal human beings for sharing an audio file it claims might not exist at all.

Asked whether telling investors an audio recording is AI — when, in fact, it is real — could cause any legal issues for Sable, Badawi said he “would expect that to be a problem when you try to defend yourself against a Reg FD claim.”

“If you said you didn’t do it and were blatantly lying, that would not help your Reg FD case,” Badawi added.

On the eve of publication, Hunterbrook called Mickelson, after he did not respond to a written request for comment sent to his representatives. He picked up, and upon hearing the reporter was calling from Hunterbrook, hung up promptly.

Instead, Mickelson took to the group chat — sharing the (incorrectly spelled) name of one of Hunterbrook’s reporters who reached out.

Mickelson shared the phone number of a different Hunterbrook reporter with the chat, prompting another member to seemingly attempt to dox Hunterbrook’s publisher using a Craigslist page including the phone number with an offer of “free dog food.” (Kind of funny.)

Others were in less of a joking mood. “Did we get subpoenaed?” asked one.

“I have a lot of lawyers, and I own a major criminal defense law firm,” replied another. “I’ll handle everyone’s legal issue. Fuck ‘em.”

Authors

Sam Koppelman is a New York Times best-selling author who has written books with former United States Attorney General Eric Holder and former United States Acting Solicitor General Neal Katyal. Sam has published in the New York Times, Washington Post, Boston Globe, Time Magazine, and other outlets. He has a BA in Government from Harvard, where he was named a John Harvard Scholar and wrote op-eds like “Shut Down Harvard Football,” which he tells us were great for his social life. Sam is based in New York.

Till Daldrup joined Hunterbrook from The Wall Street Journal, where he focused on open-source investigations and content verification. In 2023, he was part of a team of reporters who won a Gerald Loeb Award for an investigation that revealed how Russia is stealing grain from occupied parts of Ukraine. He has an M.A. in Journalism from New York University and a B.S. in Social Sciences from University of Cologne. He’s also an alum of the Cologne School of Journalism (Kölner Journalistenschule). Till is based in New York.

Editors

Jim Impoco is the award-winning former editor-in-chief of Newsweek who returned the publication to print in 2014. Before that, he was executive editor at Thomson Reuters Digital, Sunday Business Editor at The New York Times, and Assistant Managing Editor at Fortune. Jim, who started his journalism career as a Tokyo-based reporter for The Associated Press and U.S. News & World Report, has a Master’s in Chinese and Japanese History from the University of California at Berkeley.

Dhruv Patel, Matthew Termine, and Gabi Josefson also contributed reporting.

This investigation underwent dedicated fact-checking by two fact-checkers, as well as review by multiple Hunterbrook attorneys.

Hunterbrook Media publishes investigative and global reporting — with no ads or paywalls. When articles do not include Material Non-Public Information (MNPI), or “insider info,” they may be provided to our affiliate Hunterbrook Capital, an investment firm which may take financial positions based on our reporting. Subscribe here. Learn more here.

LEGAL DISCLAIMER

© 2025 by Hunterbrook Media LLC. When using this website, you acknowledge and accept that such usage is solely at your own discretion and risk. Hunterbrook Media LLC, along with any associated entities, shall not be held responsible for any direct or indirect damages resulting from the use of information provided in any Hunterbrook publications. It is crucial for you to conduct your own research and seek advice from qualified financial, legal, and tax professionals before making any investment decisions based on information obtained from Hunterbrook Media LLC. The content provided by Hunterbrook Media LLC does not constitute an offer to sell, nor a solicitation of an offer to purchase any securities. Furthermore, no securities shall be offered or sold in any jurisdiction where such activities would be contrary to the local securities laws.

Hunterbrook Media LLC is not a registered investment advisor in the United States or any other jurisdiction. We strive to ensure the accuracy and reliability of the information provided, drawing on sources believed to be trustworthy. Nevertheless, this information is provided “as is” without any guarantee of accuracy, timeliness, completeness, or usefulness for any particular purpose. Hunterbrook Media LLC does not guarantee the results obtained from the use of this information. All information presented are opinions based on our analyses and are subject to change without notice, and there is no commitment from Hunterbrook Media LLC to revise or update any information or opinions contained in any report or publication contained on this website. The above content, including all information and opinions presented, is intended solely for educational and information purposes only. Hunterbrook Media LLC authorizes the redistribution of these materials, in whole or in part, provided that such redistribution is for non-commercial, informational purposes only. Redistribution must include this notice and must not alter the materials. Any commercial use, alteration, or other forms of misuse of these materials are strictly prohibited without the express written approval of Hunterbrook Media LLC. Unauthorized use, alteration, or misuse of these materials may result in legal action to enforce our rights, including but not limited to seeking injunctive relief, damages, and any other remedies available under the law.

Hunterbrook used a custom script to collect every post and reply from Mickelson’s official X account (@PhilMickelson) since his first post in August 2018. The dataset was then searched for mentions of “Sable,” “SOC,” or “Flores,” yielding just under 100 results, nearly half from the past two months. Another 40 posts / comments — identified via natural language processing — were related to Sable’s interests, including oil, Gov. Gavin Newsom, and California’s energy policy.